Equinox PCAF Mortgage Workflow

The Partnership for Carbon Accounting Financials proposed methodologies (The Global GHG Accounting and Reporting Standard for the Financial Industry, PCAF, 2020) for attributing GHG Emissions to diverse financial contracts. One of the currently developed asset classes concerns Mortgage portfolios. The methodology as implemented in Equinox is documented below.

For the methodologies themselves consult the corresponding PCAF documentation or the Open Risk Manual Entries

The PCAF Workflow of Mortgages

The PCAF Methodology for Mortgages is an attribution and reporting methodology for Residential Mortgage Portfolios. The implementation of the methodology within Equinox follows the principles articulated in the White Paper Economic Networks as Property Graphs (OpenRiskWP08_131219) which emphasizes the proper capture of dependencies between the different economic actors involved. In this use case this translates into the following data models:

- Borrowers as special class of Counterparties

- Mortgage loans as special class of Loan contracts

- Buildings as special type of Asset (references as collateral)

- Building Emissions Sources as a special sustainability attribute of Buildings

Workflow Steps

The following steps indicate the PCAF workflow for Mortgage Attribution and Reporting within Equinox

-

Insert Mortgage Loans that are part of Portfolio. Critical Fields:

- Asset Class (Residential)

- Total Balance

-

Insert Real Estate that Backs Mortgages. Critical Fields:

- Asset Class (Residential)

- Initial Valuation Amount

-

Building Emissions Sources. Critical Fields

- Asset Reference

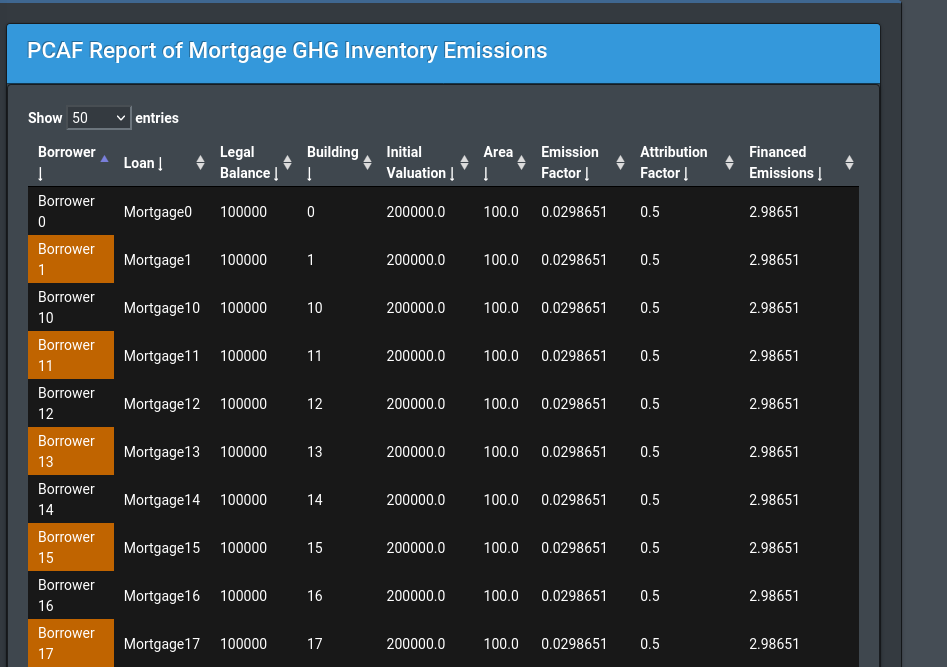

Repeat the above process for all emission sources in your mortgage portfolio. The estimated mortgage portfolio emissions can be found in the Portfolio Status menu under PCAF Mortgage Report

Further Reading and References

Check out other Equinox use cases and Workflows

- The GHG Scope 2 Workflow focuses on Scope 2 (purchased electricity) accounting and reporting.

- The Green Public Procurement Workflow that supports analysis conforming to the data models of the European Union TED platform.

- The CIRIS Workflow for compiling a City-wide emissions report

- The PCAF Project Finance Workflow

- The GHG Project Workflow that focuses on individual Project impact analysis (thus this is an example that does not need involve a portfolio).

- The Emission Factor Database Workflow illustrates working with reference data (in this case the IPCC emissions factor database)

- The EBA Scorecard for Project Finance implements a standardized credit scorecard for Project Finance