Open Source Risk Models

Open Source is Core to our Vision

As stated in our mission, Open Risk advocates and supports open source, transparent, peer reviewable, methodologies and risk models. From the Great Financial Crisis, to the Covid-19 Pandemic, the Sustainability Challenge and onwards, time and again we see conventional (proprietary and closed) risk models and risk management tools being challenged, failing to deliver their purported utility when it is needed most.

Openness and transparency cannot provide solutions where none exists, but they can ensure that there is no over-reliance on elements that are not fit-for-purpose. Dispelling a false sense of security prevents surprises but also creates the conditions for focusing energy and talent on tackling the harder problems.

This point of view has been the motivation for our Open Source Risk Model Manifesto and we firmly believe that Open Source is the Future of Risk Modeling.

If you embrace the open source vision this page offers a number of resources and pointers to our work (and the work of others) to get you started with open source risk models. If you are already onboard it may help initiate the next stage of your journey!

The Tools of the Trade

Open Risk promotes and supports the use of open source and non-proprietary frameworks, standards and languages for the development of open, transparent risk modelling tools and solutions.

There is already a fantastic set of building blocks available for supporting an open source risk modelling universe, including but not limited to:

- The Python language, tools and libraries

- R, the statistics and modelling language and libraries

- The Julia language, tools and libraries

- The C++ language and Libraries

We advocate a toolkit view that uses the best tool for each risk management task. For an in-depth list of functionality comparing the Python, Julia and R ecosystems please take a look at this side-by-side catalog

Python as the glue language for an open source risk management ecosystem

Open Risk promotes, in particular, the use of Python, a modern, free, powerful and widely available computing platform for the prototyping, documenting and validating of risk analytics relevant for risk management. One of the many benefits of adopting Python is that it can easily integrate already available specialized libraries such as those provided by R or C++. Our long-term objective is to build a high quality, open source risk management base (models and documentation, annotated datasets) that will be widely available. Check our sitemap of the full list of projects

Project Overview

Anybody interested in the development of open source risk management tools is welcome to join the Open Risk Commons where we coordinate our activities. We are also operating a GitHub collection of repositories for the collaborative development of open source risk management tools

The number and maturity of available libraries is growing monotonically, here is a sampler of the current list (check out the repository for various other projects in alpha stage):

Portfolio Management Frameworks

- equinox Equinox is the open source platform for sustainable portfolio management

- openNPL is an open source platform for the management of non-performing loan portfolios. It implements the detailed European Banking Authority loan templates for NPL data enabling the collection and easy management of loan data according to best-practices

Risk Modelling Frameworks and API’s

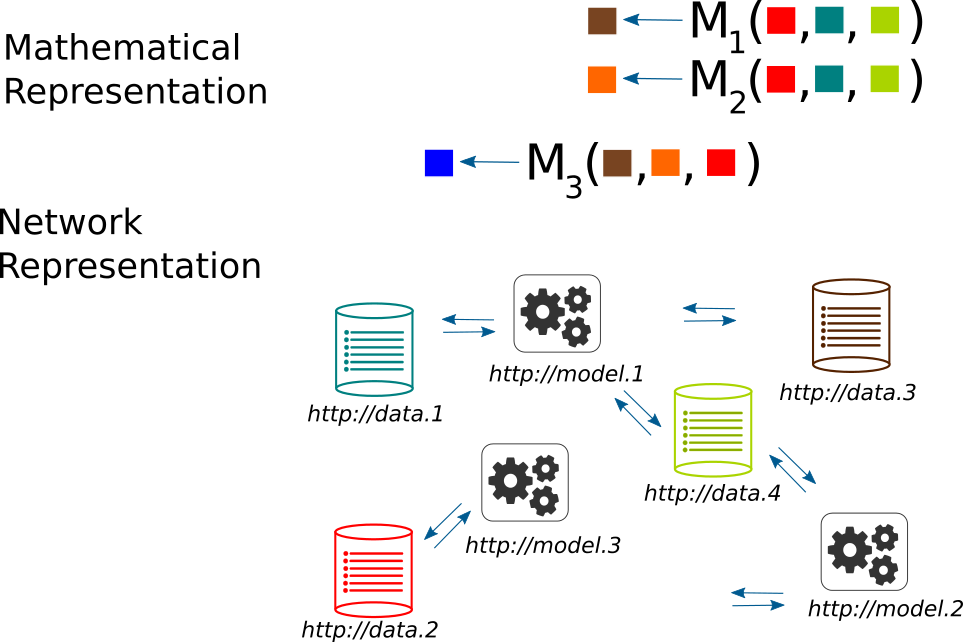

- openLGD and the related openRiskScore are Python powered libraries for the statistical estimation of Credit Risk (Probability of Default and Loss Given Default) models. They can be used both as standalone libraries and in a federated learning context where data remain in distinct (separate) servers

- openSecuritisation a proposal for a simple, open and transparent securitisation modeling framework

Specific Libraries

- transitionMatrix is a Python library for the statistical analysis and visualization of state transition phenomena. It can be used to analyze any dataset that captures timestamped transitions in a discrete state space. Use cases include credit rating transitions, system state event logs etc.

- correlationMatrix is a Python library for the statistical analysis and visualization of correlation phenomena. It can be used to analyze any dataset that captures timestamped values (timeseries) The present use cases focus on typical analyses of market correlations, e.g via factor models

- concentrationMetrics is a Python library for the computation of various concentration, diversification and inequality indices.

- portfolioAnalytics is a Python library that provides semi-analytical functions useful for testing the accuracy of credit portfolio simulation models