Crash Course on Input-Output Model Mathematics

Summary

A brief review of the linear algebra and matrix theory concepts underpinning standard environmentally extended input-output models.

Content

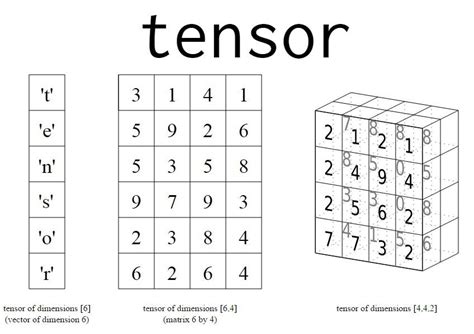

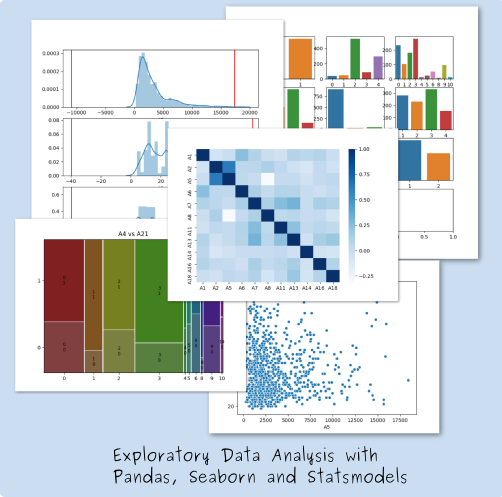

This brief introduction in Input-Output Model mathematics discusses the basic elements of linear algebra that are necessary to understand the standard Input-Output models, including their Environmental impact extensions.

Matrix theory is the main subject covered here as it is the most dominant mathematical tool used in this area (though other parts of mathematics do find applications in Input-Output analysis). The focus is on the notation and mathematical objects commonly used, not the economic interpretation or any mathematical proofs.