Risk Compensation: From Face Masks to Credit, Market and Systemic Risk

What is Risk Compensation?

Risk Compensation is a behavioral model of human attitudes towards risk which suggests that people might adjust their behavior in response to the perceived level of risk. It follows that, depending on the strength of the effect, that it might counteract and even annul the impact of risk mitigation, if the updated attitude and behavior modifies the actual underlying risk

Examples of potential risk compensation effects abound

A prominent example of potential risk compensation in recent times that established the concept in more formal terms in public policy debates concerned the beneficial role of safety belts in automobiles.

A famous (and controversial) related study was by Sam Peltzman, a professor of economics at the University of Chicago Booth School of Business, who published “The Effects of Automobile Safety Regulation” in the Journal of Political Economy in 1975. He suggested that risk compensation completely offsets the benefits of wearing a seat belt, hence related regulation mandating the wearing of seat belts is not effective.

Similar arguments were discussed subsequently as new safety automobile safety measures were been rolled out (such as ABS systems to prevent blocked breaking systems).

The unindented consquences of a false sense of security

The assertion, in the seat belt context, is that wearing a seat belt makes one drive less cautiously (for example faster, closer to other vehicles etc) and thus increases the chance of an accident. Related expressions that are used to capture such phenomena are “false sense of security” and “unindentend consequences”, the first alluding to the psychological mechanism that might be at play and the second to the altered outcomes

Covid-19 and face mask risk compensation

The covid-19 crisis, exploding in global consciousness in early 2020, touches on many issues of best practice Risk Management, from the difficulties of Risk Quantification to Business Continuity.

Medical face masks are a common risk mitigation measure against the spread of epidemics linked to infectious diseases. Yet the precise benefit is very context dependent, with at least the following factors playing some role:

- the nature of the disease (degree of virulence, symptoms produced etc.)

- the physics of its transmission from person to person (droplets, airborne etc.)

- the behavioral context of disease carrier (cultural norms, adherence to other policy instructions etc.)

- the efficacy of the mask itself and the degree to which it is used properly and

- the proportion of people actually wearing a mask

Illustrative of the very non-trivial question of the usefulness of masks, at some point during the pandemic WHO officials did not recommend mask wearing for healthy members of the general population stressing that masks are commonly misused, and as a result, won’t offer the intended protections. We have a tangible example of potential risk compensation, which can be used to probe into the questions that arise when risk managers face (pun) similar challenges in other contexts.

The complexity of identifying true residual risk

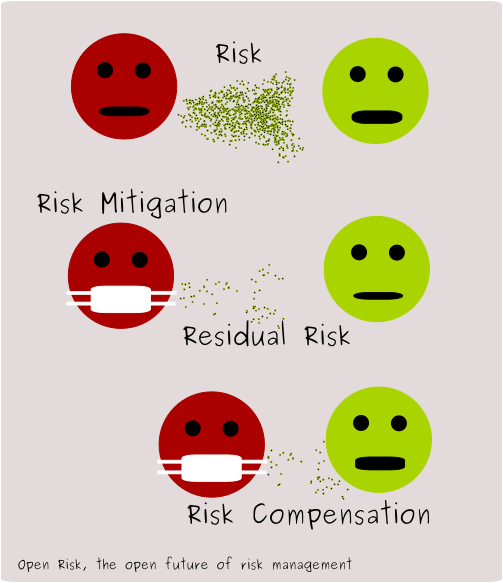

For concreteness, let us use the medical face mask discussion to cast the standard analytic risk management framework in a tangible and everyday context that highlights the ever present challenges. The following pictogram captures for us the “big picture” and we will proceed to explore it in some more verbal detail:

1. Risk Identification

Risk Identification is the first step of formal risk management, which in our little “case study” would be the recognition that there is indeed a viral epidemic and its broad negative impact. Now this may seem obvious today but even a few centuries ago societies may interpret a pandemic in very different ways!

Needless to say that the identification process itself has many, many, ramifications and pitholes which we will not go into here. In a previous post we saw, for example, how difficult it is to define “risk” in general. Case in point, the varying impact of covid-19 to people of different age means that different segments of the population will have very different behavioral response.

2. Risk Measurement

Risk Measurement or Risk Quantification is the process of turning the results of the previous risk identification step into some concrete measures or metrics. This allows people to place the potential impact in context of other uncertainties they might be facing. Again, the pandemic offers many examples of problematic measurements (whether due to objective obstacles or subjective biases), incompatible definitions, lack of control groups etc.

3. Risk Mitigation

Risk Mitigation is the very important third step where risk already identified and measured is actually mitigated (treated).

The means of mitigating risk vary enormously depending on the nature of the risk. Face masks are obviously a potential way to mitigate risk by preventing a certain pathway of infection (through droplets coughed or sneezed by infected people).

Residual Risk

The degree of effectiveness of the face mask risk mitigation measure (which depends on all those factors we mentioned above) determines the degree of Residual Risk.

Residual Risk is the risk remaining after a certain Risk Mitigation strategy has been pursued. It denotes a risk that is (hopefully!) of lower impact in terms of either probability or consequences.

For example residual risk in the face mask context it would be the continuing chance of being infected while being in the vicinity of an infected person (or potentially the severity of the infection).

Residual risk may exist for various reasons for example:

- In-principle impossibility to completely eliminate a given risk

- The excessive cost of completely eliminating a risk

The amount or residual risk might be difficult to establish. This could be the case both if the risk itself or the impact of the risk mitigation is difficult to quantify.

Risk Compensation

We see already that the question of how much residual risk remains after a population starts wearing a mask does not have a simple answer. But things do get even more complicated… namely:

A large variety (if not all) of relevant risks we are facing and need to manage are not one of realizations but recurrent processes (similar risk events will happen again in the future).

This means that how we go on with life after risk mitigation is in place may potentially alter the future risk landscape we are facing. The concept of risk compensation is obviously relevant only in situations where there is ongoing and material residual risk after risk mitigation but this is actually the norm rather than the exception.

Risk compensation is a high level theory, addressing a complex phenomenon. It posits, for a start, that people have a given Risk Appetite level. It suggests that if risk mitigation is in place, thus effectively reducing the underlying risk, people will change behavior to increase the risk back to desired level. In the example of face masks, people might ignore other instructions (e.g. about personal hygiene of physical distancing).

Whether that behavior is indeed true and the precise new level or residual risk depends on three key pillars:

- The degree and quality of understanding of the overall risk landscape

- The degree and quality of understanding of the effectiveness of the mitigation

- Very importantly, the reward associated with taking more risk

In any case, it is rather obviously wrong to assume that risk compensation always negates all the benefits of risk mitigation.

If a vaccine is found and dramatically reduces the number of infected individuals people will not actively seek them out maintain the same level of risk!

Risk Compensation in Financial Risk Management

In the context of financial risk management risk compensation is an important consideration because many types of risk taking are actually compensated, potentially very well so.

Examples of risk compensating behavior in financial risk management are quite frequent. Two important categories that have been discussed quite extensively in the literature in this context are:

- The impact of more competent management (better managers feeling more secure taking risks)

- The impact of higher quality risk quantification (better risk management tools and risk models creating a false sense of security)

Better risk management tools leading to more risk?

A couple of examples are sufficient to sketch how the mechanisms of risk compensation may have unintended consequences and the nature of these failures:

- Credit ratings are unequivocally useful in facilitating the operation of credit systems (as a starting point) as they help systematize the assessment of credit risk. Yet once adopted widely they may encourage risk compensation by the seeking out of arbitrage opportunities e.g. instances where the adopted credit risk measure does not reflect the actual risk. Furthermore, credit risk mitigation transactions (Credit Derivatives or Securitisation) may overstate the actual risk reduction achieved.

- Market risk measures (such as Value-at-risk) perform a similar role in the managing of risk of traded portfolios of financial assets: they provide an invaluable summarization of facets of the risk landscape which can (under the illusion of total objectivity) create the room for excess risk taking. Similarly, hedging transactions may overstate the risk reduction (e.g. in conditions of market stress)

In fact, the study of risk compensation in the financial system shows us some potential long term effects that are not easily visible in the context of the pandemic risk. The arbitraging of risk measures and ineffective risk migitation does not have immediately visible impact but only plays out during major “regime change” events.

In essence risk compensation creates a gradual flattening of the risk curve, which unlike the flattening of the pandemic curve is not benign, as it is removing short term surprises in favor of medium-longer term surprises.

The more insidious manner in which risk compensation might affect the quality of our risk management over longer periods is by shifting risks from the more obvious, idiosyncratic, common and "manageable" to the less obvious, systemic, unusual and unmanageable

Comment

If you want to comment on this post you can do so on Reddit or alternatively at the Open Risk Commons. Please note that you will need a Reddit or Open Risk Commons account respectively to be able to comment!