Climate Dictionary Quiz

The Climate Dictionary Quiz is now accessible as a course at the Open Risk Academy. The Quiz is based on the UN Climate Dictionary and provides an interactive educational tool to enable deeper understanding of the essential terminology.

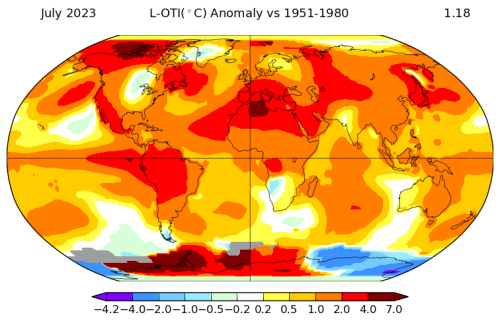

The Climate Dictionary is an initiative of the United Nations Development Programme (UNDP) aimed at providing people worldwide with a simplified guide to understand climate change. The Dictionary (first published Aug 2023) seeks to bridge the gap between complex scientific jargon such as present in the IPCC publications and other scientific bodies and the public.