The Atlas of Bad Risk Management

The Atlas of Bad Risk Management

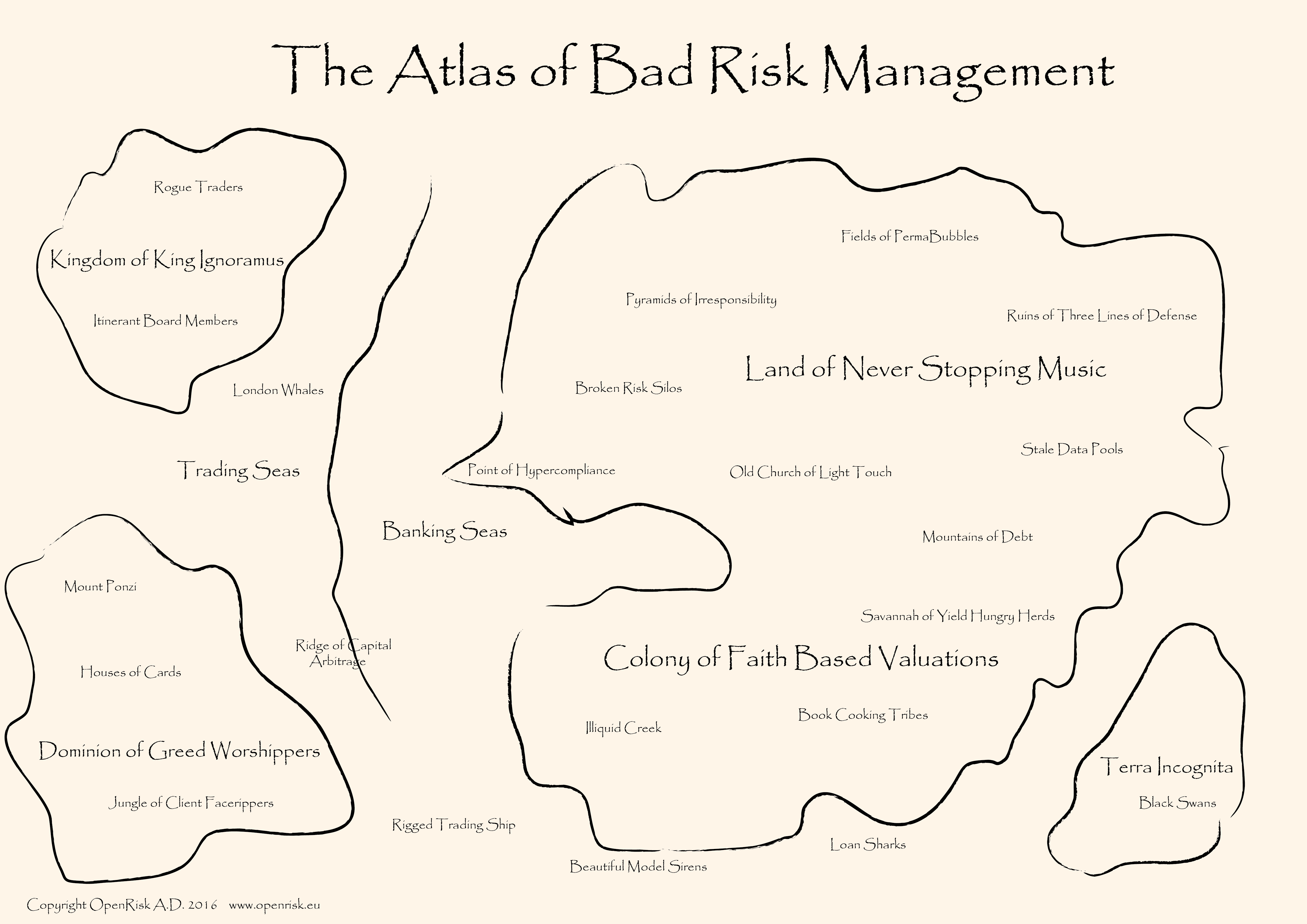

The Atlas was discovered recently in archaeological work studying pre-crisis civilizations. Despite the obvious wear and tear, all key risk failure areas have been preserved. We note the remarkable diversity of organizational forms and economic structures. Most interestingly, there is even an uncharted territory that was rumored to be inhabited by black swans.

We handed over this invaluable treasure to a risk management expert and asked her to identify any similarities with modern risk management challenges. She provided the following responses (abridged):

The Kingdom of King Ignoramus

The kingdom is a metaphor for a hierarchical organization and King Ignoramus refers to poor corporate governance, in particular failures of oversight. Rogue Traders are of course one of the more colorful instances Internal Fraud

The Dominion of Greed Worshipers

Self-interest is a moving force in society but in this territory it reaches its un-natural extremes. The Mountain of Ponzi dominates the view but in the valleys below are where people build precarious Houses of Cards. In the dense jungles of the south the Client Facerippers will stop at nothing to extract commercial advantage.

The Land of Never Stopping Music and the Colony of Faith Based Valuations

This is the largest continent where the majority of the Atlas inhabitants reside. Here bad risk management is less of a malicious intend and more a case of poor systemic design

The Old Church of Light Touch propagates the belief that lack of regulation is the only good regulation. The Point of Hyper-compliance is where Box-Ticking compliance exercises come to die. The Broken Risk Silos are not faulty grain storage, it is where organizations fail to communicate and manage their risk in an integral manner.

The Pyramids of Irresponsibility express a general pattern of poor risk management that creates both confusion and ineffective response. The Ruins of the Three Lines of Defense is a romantic reminder that schematic recipes for risk management may not be fit-for-purpose. The Stale Data Pools is a pungent reminder that poor Data Quality can defeat the best risk management efforts, while the Mountains of Debt and the Fields of Perma-Bubbles point to an economic-financial landscape that while awesome to behold may hide gigantic risks in plain sight.

The Yield Hungry Herds roaming the Savannah have ravenous risk appetite. Are they being served healthy food by the Book Cooking Tribes or will they all stumble and perish on a tiny Illiquid Creek (Aka: Liquidity Risk)?

The big risk management ocean between the territories

The Ocean is split (a bit like the Atlantic Ridge) into the Trading Seas and the Banking Seas, which ofcourse gives immediately the opportunity for a Ridge of Regulatory Arbitrage. The ocean is occupied by wonderful and bizarre marine creatures, like London Whales and Loan Sharks. Very worryingly, the Beautiful Model Sirens have lured many a risk manager in the honeypot traps of Model Risk.

Terra Incognita

Last but not least the famous Terra Incognita with the infamous Black Swans. If we survive all the other hurdles of the Atlas of Bad Risk Management there is always the possibility of being hit by a black swan falling from the sky