17, Sustainable Public Procurement, Part I, Emissions Attribution

Open Risk White Paper 17: Sustainable Public Procurement. Part I: Emissions Attribution

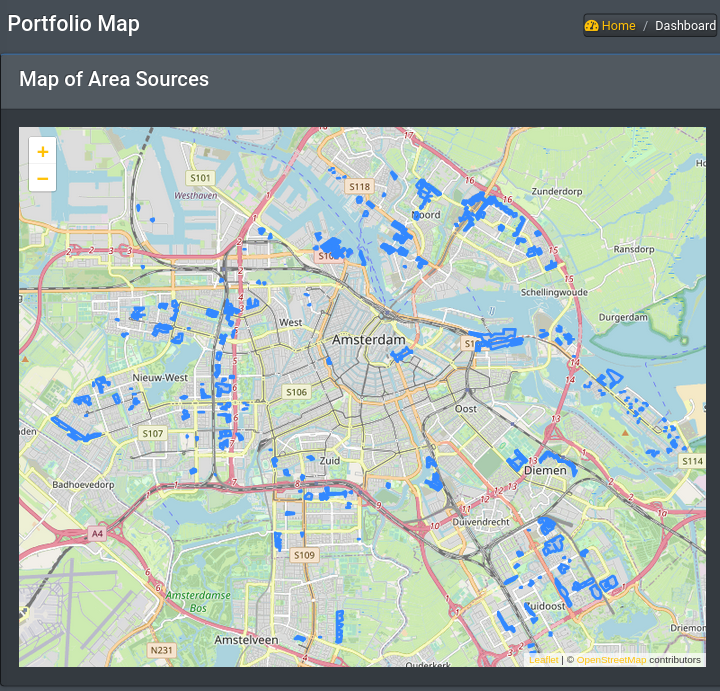

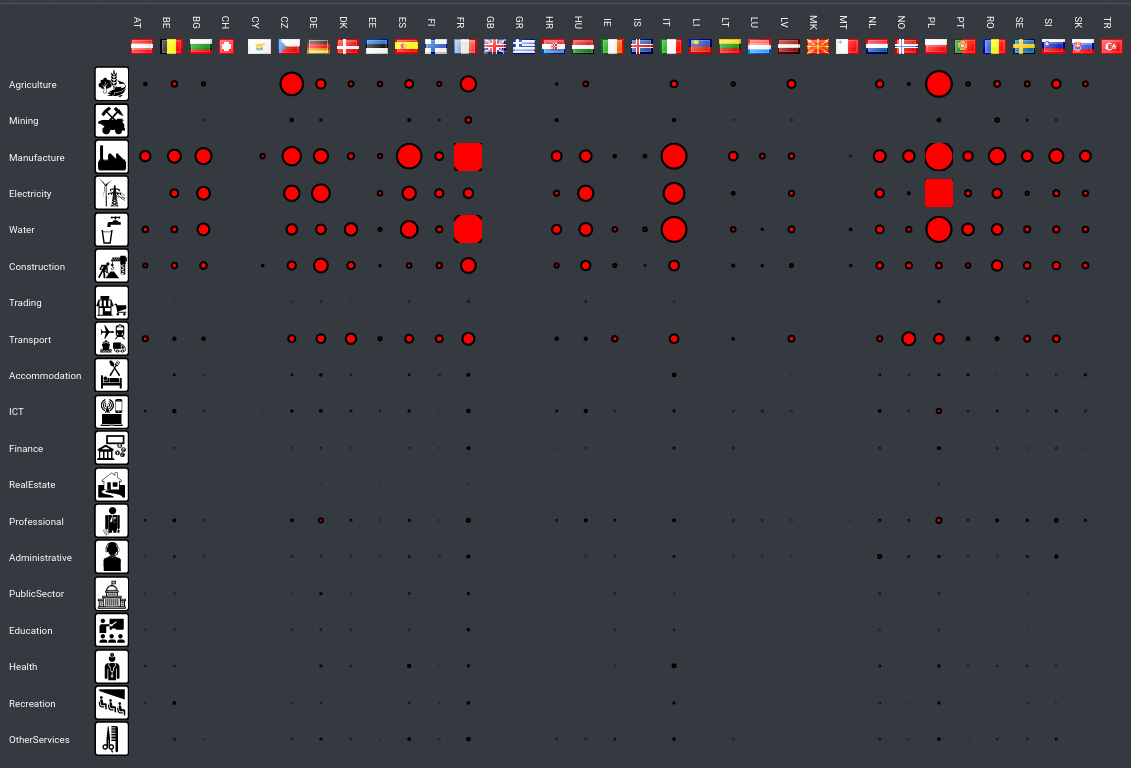

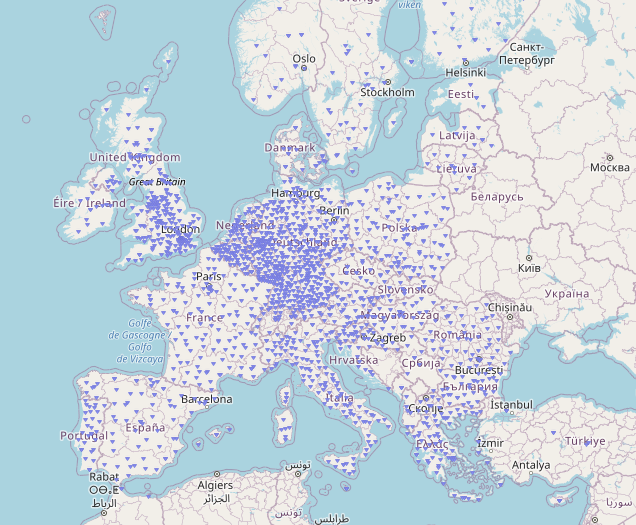

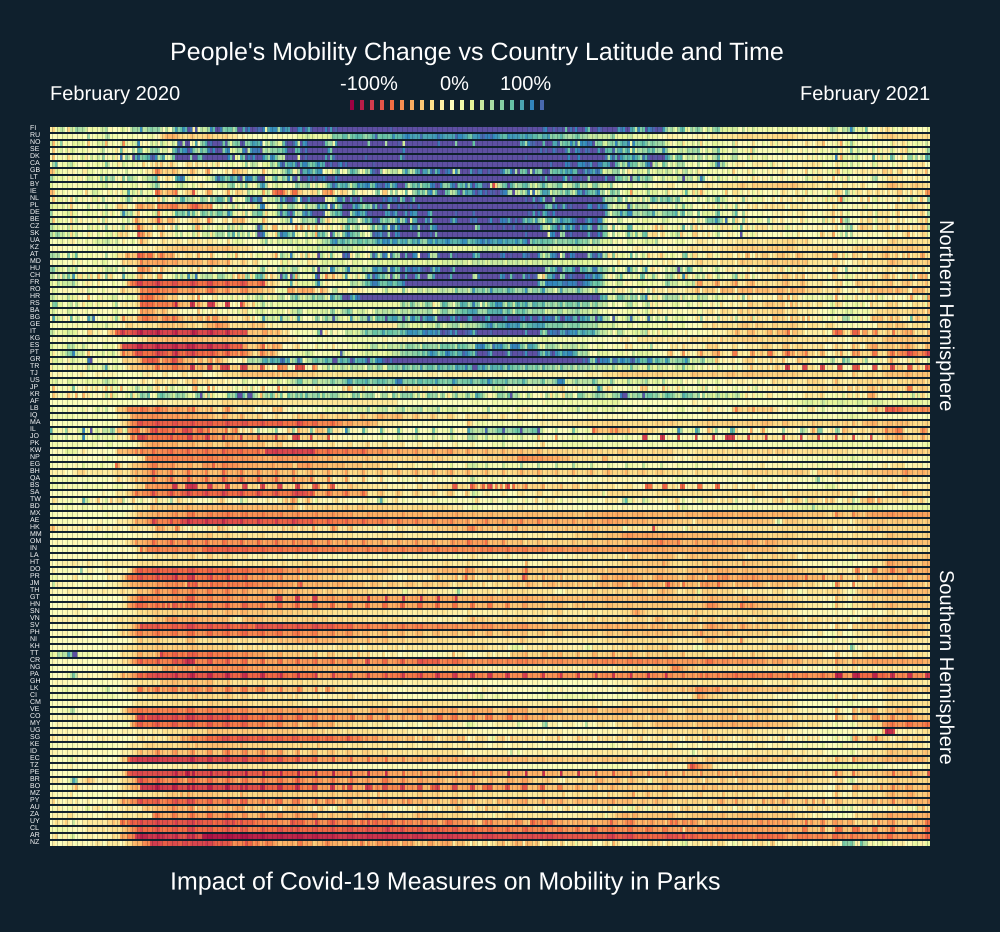

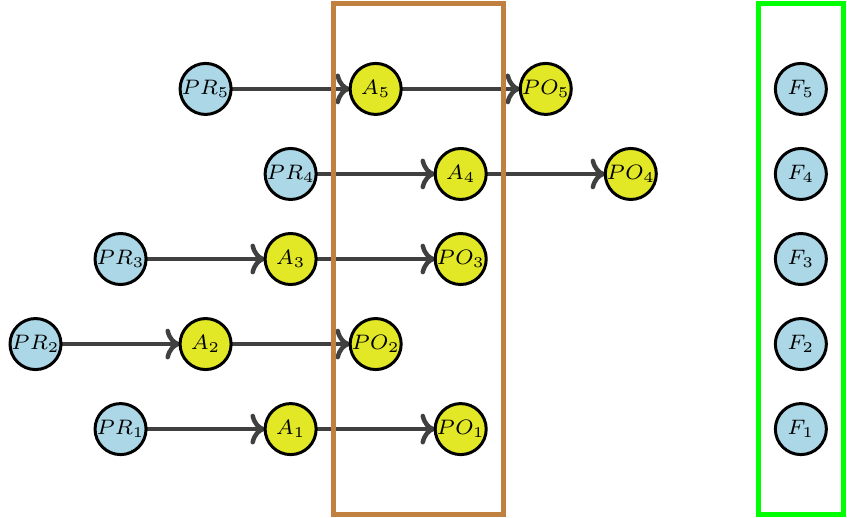

Public Procurement represents a major opportunity to catalyze the transition of economies towards more sustainable patterns but faces important challenges. We review mechanisms that can help address key pain points through the use of open standards, open data and open source tools. In the first part we frame the overall task of Sustainable Public Procurement as an instance of portfolio management. We outline three distinct information processing pillars that are relevant in this context. We focus here on the task of measuring and attributing greenhouse gas emissions to an existing procurement portfolio.