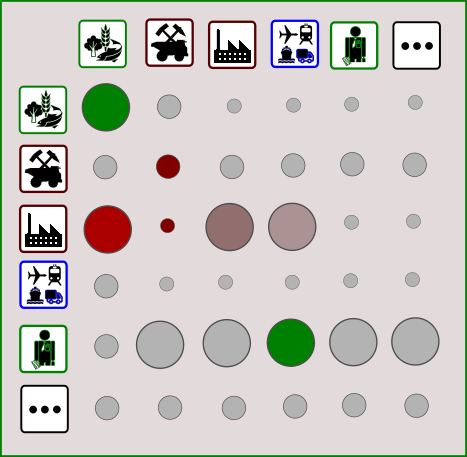

Updated Open Risk Academy Course: Input-Output Models with Python

A DeepDive Course into using Python to work with Input-Output Models

Expanding on the popular Input-Output Models with Python course

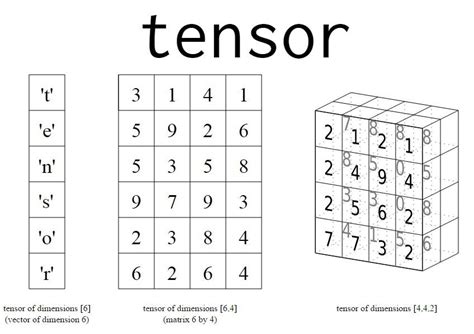

The SFI32064 course is a DeepDive with nine segments, exploring Input-Output models using Python and the Pymrio library. The following is an updated overview of it contents.