Equinox: a Platform for Sustainable Project Finance Risk Management

On Earth Day 2021 we are happy to launch Equinox, an open source platform supporting sustainable project finance

Motivation

Equinox is an open source platform that supports holistic risk management and reporting of Sustainable Finance (Sustainable Portfolio Management). The platform integrates geospatial information with applicable regulatory and industry standards from EBA, PCAF and Equator Principles to provide a holistic view of the footprint of both individual projects and portfolios, in particular of project finance investments.

Sustainability (understood in environmental, economic and social terms) is emerging as an undisputed constraint that will shape future human activity and more specifically how the financial system facilitates and empowers economic life.

Developing tools and methodologies that improve the ability of all stakeholders to assess and report risks in sustainable finance context is an important and timely objective. Within the broader spectrum of financial system arrangements and products, Project Finance plays a cornerstone role, with billions of financing being arranged annually for projects spanning the range from energy, minerals, water, transport and other infrastructure.

The financed projects include frequently categories of developments and assets with “significant” ESG footprint, whether in terms of green house gas emissions, impact on biodiversity or impact on local communities. This fact has been recognized early and e.g. the Equator Principles initiative is one of the earliest efforts in what is now termed Sustainable Finance .

At Open Risk we believe that transparency reduces risk. For sustainable finance to be less prone to the risk management pathologies that repeatedly plague the financial sector we champion the adoption and use (wherever possible) of open source and open data practices.

On Earth Day 2021 we are happy to launch a new project that is aimed at providing an open source building block supporting sustainable project finance.

What exactly is Equinox?

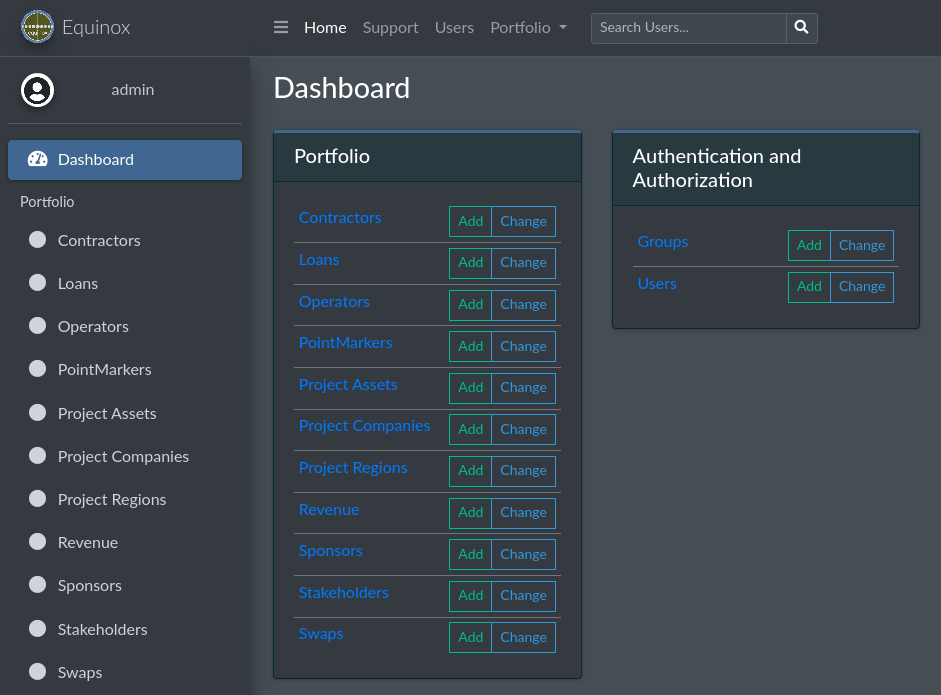

Equinox is an integrated database and web application that works together with domain specific data schemas to provide an easy tool to collect, store, work with and report Project Finance data.

The data architecture implements regulatory and ESG and industry recommendations and best practises. Running the application creates a server that can then be accessed via any regular browser:

Equinox Functionality

The equinox platform aims to cover all information types and flows that are relevant for Project Finance, at least at the portfolio level. Here we break down some of the currently implemented subsets (More will follow as the platform develops!)

-

- Credit Risk Analysis

-

- GHG Emissions Reporting

-

- Equator Principles

-

- Geospatial Information

1. Standardized Credit Risk Analysis

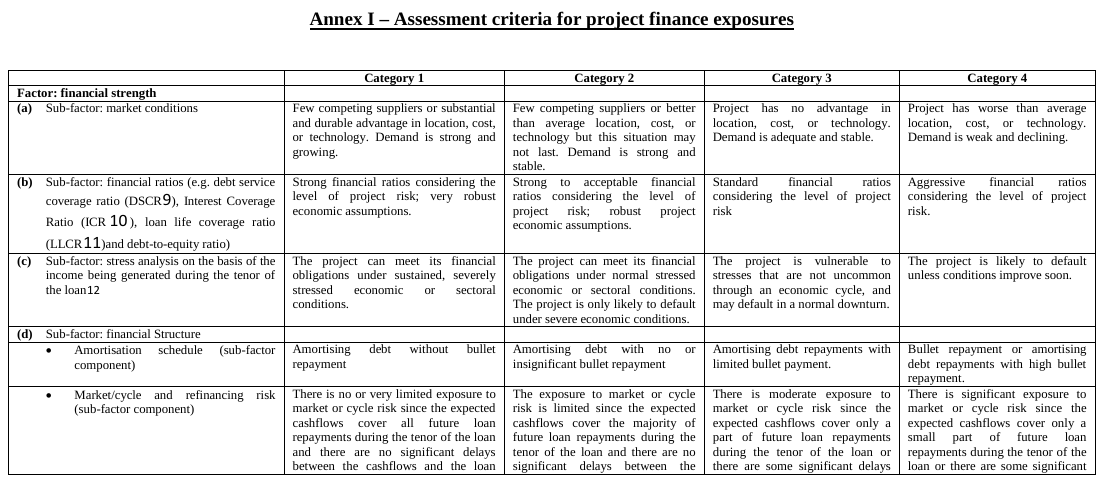

Project Finance Credit Risk Analysis may involve arbitrarily complicated tools and risk models, depending on the nature, size and complexity of the project being financed. As a common denominator, regulatory frameworks (starting with Basel II Specialized Lending ) articulate a simplified (standardized scorecard).

In the context of European regulation, the EBA Guidelines on Loan Origination and Monitoring specify concrete requirements:

Institutions should assess the primary source of repayment of the loan, which is the income generated by the assets (project) being financed. Institutions should assess the cash flow associated with the project, including future income-producing capacity once the project is completed, taking into account any applicable regulatory or legal restriction (e.g. price regulation, rate-of-return regulation, revenues being subject to take-or-pay contracts, environmental legislation and regulations affecting the profitability of a project).

Further, in terms of assigning a Credit Rating and *risk weighted assets", the European Banking Authority’s Regulatory Technical Standards1 lay out a specific standardized scorecard methodology:

All the required data points for deriving a score according to the regulatory assessment criteria are implemented in Equinox. The scorecard information is organized along Risk Factor Groups:

- Financial Strength

- Political and Legal Environment

- Project Characteristics

- Strength of Sponsor

- Security Package

with each group including a number of Risk Factors and Sub-Factors. In equinox these data points are grouped according to an expanded ontology of parties (legal entities) and concepts involved in Project Finance:

- The Asset being financed and associated revenue analysis

- The Project Company (e.g SPV)

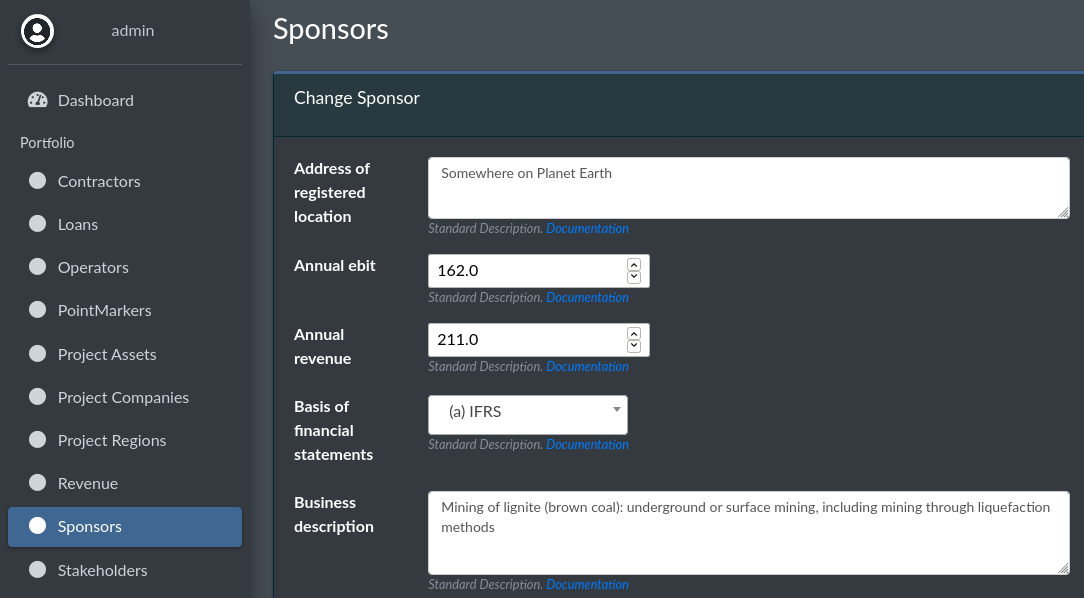

- The Sponsor entity(ies)

- Contractors and Operators

- The Loan(s) and other products involved (e.g Swaps)

- The Stakeholders

Data entry for numerical or text inputs is via convenient web forms. For example a segment of the Sponsor information:

2. Standardized GHG Emissions Reporting

The previous section discusses the support of standardized credit risk analysis without any particular drill-down into the ESG issues. (Conceptually those are covered by criteria within the Political and Legal Risk Factor groups, e.g. Political Risk and Project Approval Risk).

Currently, there are very active developments towards detailed sustainability assessment criteria in various lending activities. Equinox will in due course incorporate any mature framework that helps create a complete picture of the risk profile of a project. One of the areas already relatively advanced is the accounting and reporting of Green House Gas Emissions based on the GHG Protocol.

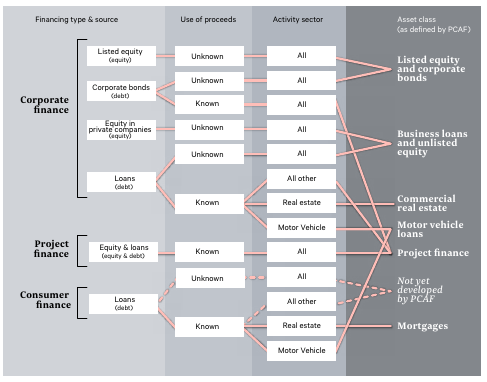

The Partnership for Carbon Accounting Financials has proposed an overall approach that covers several types of financing and specifically also for Project Finance. The PCAF Methodology for Project Finance offers a number of different options (under different data availability assumptions). The core principle is that measured emissions are attributed proportionally to financing amounts.

To support collecting and reporting emission information Equinox implements (per-project) data collection of GHG emission estimates (CO2 equivalents)

Equator Principles

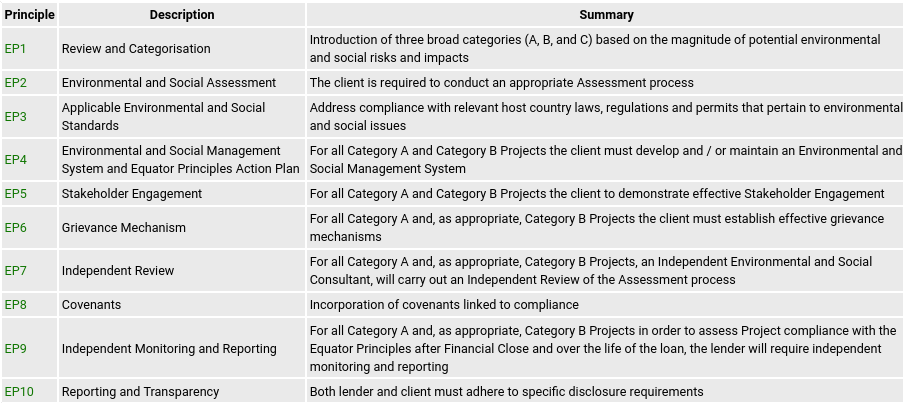

A third component implemented in the first release of Equinox are the recommendations of the Equator Principles . The Equator Principles is a risk management framework, adopted by financial institutions, for determining, assessing and managing environmental and social risk in projects and is primarily intended to provide a minimum standard for due diligence and monitoring to support responsible risk decision-making.

The Equator Principles cover in particular the social dimension of the ESG criteria by explicitly documenting stakeholder relations in all phases of a project development and operation.

Within Equinox, the current implementation focus is on capturing the final text / outcome of the compliance assessment.

Geospatial Data

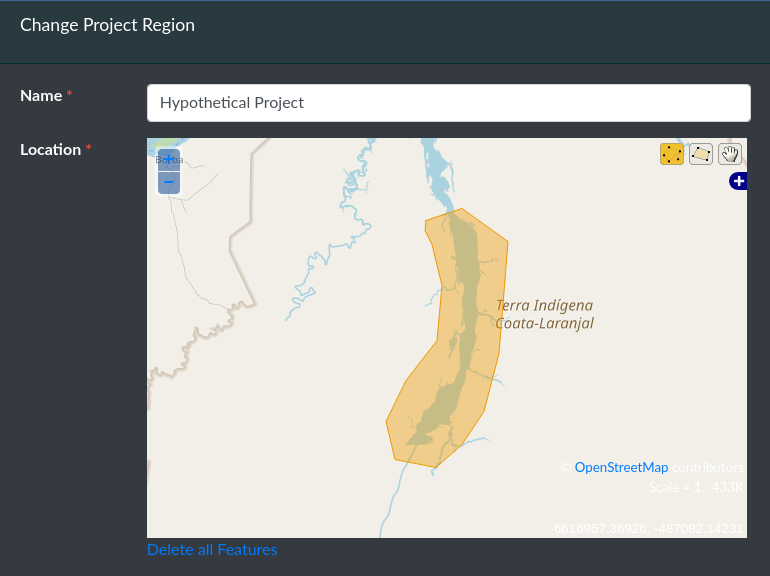

Sustainable Finance frequently involves projects and developments with very specific geospatial profiles. This profile can be the usually fixed and well-defined location of e.g., a wind turbine, a coal mine, an oil platform or a nuclear power plant. It can also be the more extended domain of e.g. a new road system or a hydroelectric dam.

Equinox enables the creation of geospatial features associated with each such project. Currently, it supports two types of features:

- Markers (single location pins)

- Polygon regions

Who is Equinox for?

Equinox should be useful to anybody involved in compiling, analysing and reporting on the risk profile of Project Finance portfolios. It offers an open and forward looking architecture that can easily interoperate with other tools and evolve along with the requirements of the growing sustainable finance field.

The current release is an early release. Any interested party is welcome to join the Equinox community to help shape its development. We welcome feedback, code or data contributions and feature requests via github.