Open Risk White Paper: Sustainable Portfolio Management - Attribution and Allocation of Greenhouse Gas Emissions

We develop an analytic framework that synthesizes current approaches to sustainable portfolio management in the context of addressing climate change. We discuss the different required information layers, approaches to emissions accounting, attribution and forward-looking limit frameworks implementing carbon budget constraints.

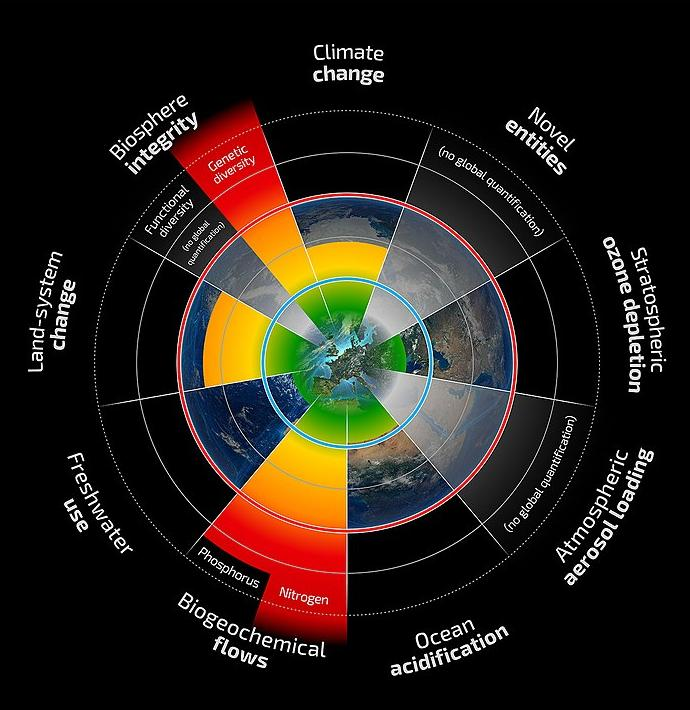

The frontpage graphic is adapted from Steffen et al. “Planetary Boundaries: Guiding human development on a changing planet”. Science (2015). The Planetary Boundaries concept was proposed in 2009 by this group of Earth system and environmental scientists. The group suggested that finding a “safe operating space for humanity” is a precondition for sustainable development. The framework is based on scientific evidence that human actions since the Industrial Revolution have become the main driver of global environmental change.

Sustainable Portfolio Management is an emerging concept that encompasses principles, tools, processes that help with meeting portfolio management objectives while incorporating sustainability constraints. In modern economies with a plethora of economic relations, supply chains and financial linkages, sustainable portfolio management becomes an indispensable tool for meeting the challenge of the sustainability transition. As aptly captured in the Dasgupta Review:

“We study the natural world in relation to the many other assets we hold in our portfolios, such as the vehicles we use for transport, the homes in which we live, and the machines and equipment that furnish our offices and factories. But like education and health, Nature is more than a mere economic good. Nature nurtures and nourishes us, so we will think of assets as durable entities that not only have use value, but may also have intrinsic worth. Once we make that extension, the economics of biodiversity becomes a study in portfolio management.”

In the latest Open Risk White Paper (OpenRiskWP11_021221) “Sustainable Portfolio Management: Attribution and Allocation of Greenhouse Gas Emissions”, we discuss the different required information layers, approaches to emissions accounting, attribution and forward-looking limit frameworks implementing carbon budget constraints. The white paper serves also as a first installment of the mathematical documentation of the Equinox Software Platform (code repository here).

White Paper Objectives

In this white paper we aim to set up an analytic framework synthesizing various existing GHG accounting, attribution and allocation approaches that have been proposed in recent years. The aim is to develop a common language for:

- GHG accounting approaches of direct emissions,

- GHG mitigation analysis of sustainability oriented projects,

- Portfolio level GHG emissions attribution approaches when managed emissions are indirect (such as financial portfolios

- Portfolio level GHG budget allocation approaches when financed emissions are indirect.

White Paper Structure

- The first chapter reviews and summarizes the context and need for sustainable portfolio management. The current scope is limited to discussing Greenhouse Gas (GHG) emissions: the global carbon budget concept, how this is estimated and how it cascades into portfolio level management constraints and limits.

- The second chapter goes over concepts and practices of GHG inventories and GHG accounting, which involves the attribution of emissions to concrete physical assets and processes. Many methodologies are available and our approach here parameterizes the enormous variety of low-level measurement approaches and emission factors and focuses on constructing informative portfolio views and representations of the key drivers. We cover separately the attribution of direct emissions and the challenge of attributing indirect emissions such as those influenced by financial portfolios.

- The third chapter is a brief excursion into the most fundamental aspect of the sustainability transition, the active management of emissions at the asset level in the context of concrete projects.

- The fourth chapter discusses another important aspect of portfolio management, namely the forward-looking setup of targets for portfolio steering and alignment. We elaborate here on proposed limit frameworks to guide portfolio development that are based on cascading global and nationally determined contributions to the sectoral and portfolio level.