First public release of the Solstice simulation framework

Solstice is a flexible open source economic network simulator. Its primary outcomes are quantitative analyses of the behavior of economic systems under uncertainty. In this post we provide a first overall description of Solstice to accompany the first public release.

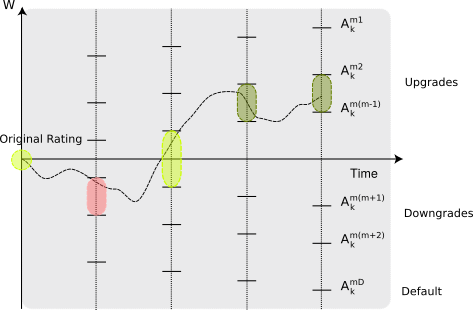

Modeling economic networks and their dynamics

Economic networks are the primary abstractions though which we can conceptualize the state (condition) and evolution of economic interactions. This simply reflects the fact that human economies are quite fundamentally systems of interacting actors (or nodes in a network) with transient or more permanent relations between them.