How to Random Walk on Supply and Use Tables

How to Random Walk on Supply and Use Tables

How to Random Walk on Supply and Use Tables (and why bother?)

Presentation given at the 16th Input-Output Workshop, March 27st 2025, Groningen, Netherlands.

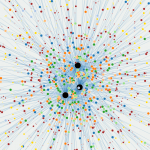

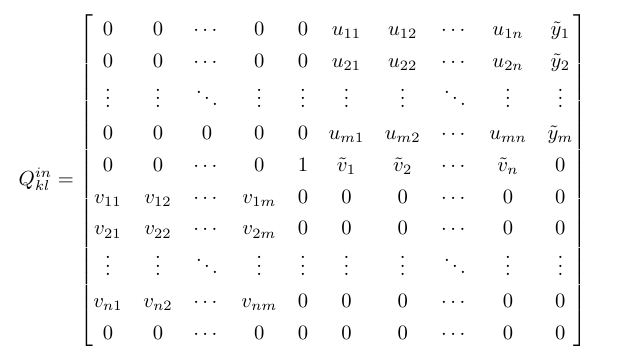

We discuss how Supply and Use tables can be mapped naturally into Bipartite Graph Networks (in various Open and Closed economy configurations).