06, Stress Testing Methodology for FX Lending

Open Risk White Paper 6: Stress Testing Methodology for FX Lending

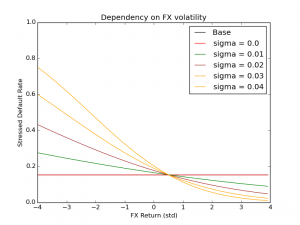

We develop a simple methodology for stress testing portfolios of credit instruments classified as foreign exchange lending. Loans whose repayment schedule is denominated in a currency other than that of the borrower’s domestic currency are commonly seen in many jurisdictions and have a risk profile that is considerably more complicated than domestic currency loans. Yet the literature for credit risk assessment and stress testing of portfolios of such loans is very limited, which means that Stress Testing and Internal Capital Adequacy Assessment (ICAAP) requirements are harder to meet. Our methodology builds on existing standard tools used in portfolio credit risk modeling and enables obtaining insights into the additional risk factors embedded in foreign currency lending.

Download

Citation

@ARTICLE{OpenRiskWhitePaper06,

author = {P. Papadopoulos},

year = {2016},

note = {\href{https://www.openriskmanagement.com/wp-content/uploads/2016/02/OpenRiskWP06_012116.pdf}{Download URL}},

title = {{Open risk WP06: Stress Testing Methodology for FX Lending}},

journal = {Open Risk White Papers}

}

Comment

If you want to comment on this post you can do so on Reddit or alternatively at the Open Risk Commons. Please note that you will need a Reddit or Open Risk Commons account respectively to be able to comment!