White Paper 02, Confidence Capital - The Principle

Open Risk White Paper 2: Confidence Capital: The Principle

We review the structure of economic capital frameworks commonly used within financial institutions and identify why the derived capital metrics do not explicitly address the needs for maintaining ongoing confidence on the soundness of the firm. In the follow-up to the financial crisis the need for more explicit such tests has been highlighted by regulatory stress testing methodologies.

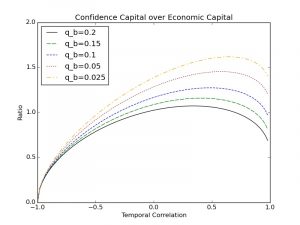

The likelihood and severity of a future ratings downgrade (as opposed to a default within the risk horizon) are the two key new risk appetite inputs required for the framework. The temporal correlation of losses beyond the risk horizon with those within the horizon is one of the main new risk parameters that are highlighted by the framework.

We derive explicit formulas for implementing a confidence capital framework in a two period setup that can lead to tractable implementations. We include a brief quantitative study that addresses a very simplified case that is solvable in terms of simple formulas. We explore the relation of confidence capital to economic capital for various choices of risk appetite and intertemporal loss correlations

Download

Source Code

Citation

@ARTICLE{OpenRiskWhitePaper02,

author = {P. Papadopoulos},

year = {2015},

note = {\href{https://www.openriskmanagement.com/wp-content/uploads/2016/02/OpenRiskWP02_040815.pdf}{Download URL}},

title = {{Open Risk WP2: Revisiting Simple Concentration Indexes}},

journal = {Open Risk White Papers}

}

Comment

If you want to comment on this post you can do so on Reddit or alternatively at the Open Risk Commons. Please note that you will need a Reddit or Open Risk Commons account respectively to be able to comment!