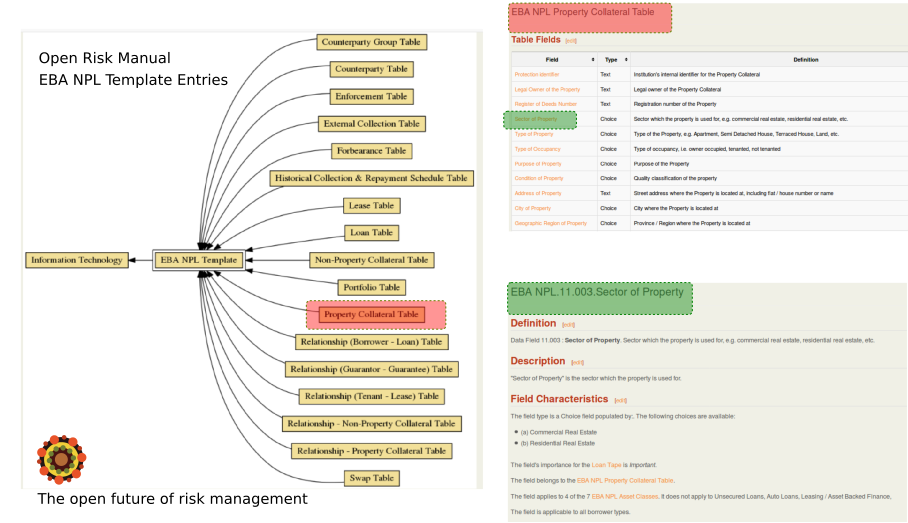

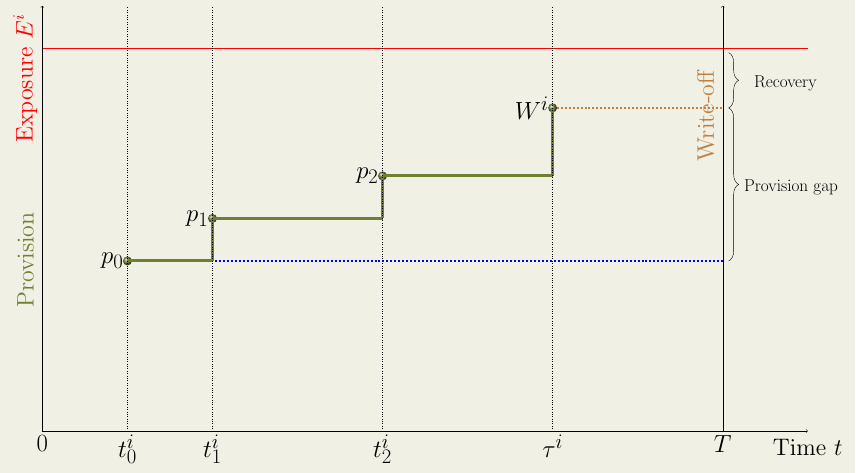

Mathematical Representations of Credit Portfolio Data

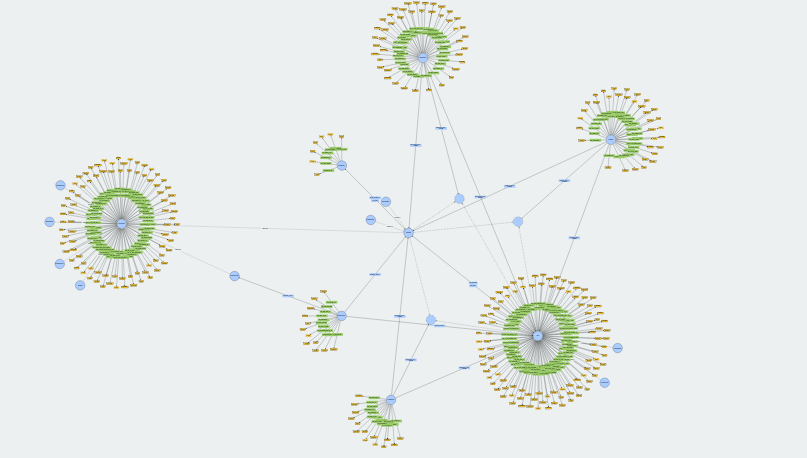

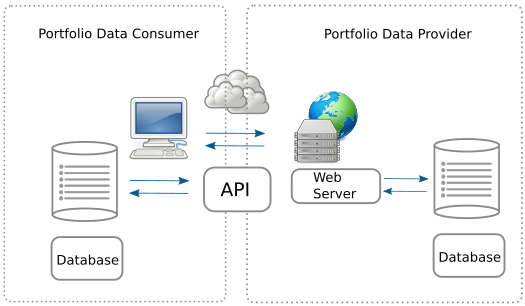

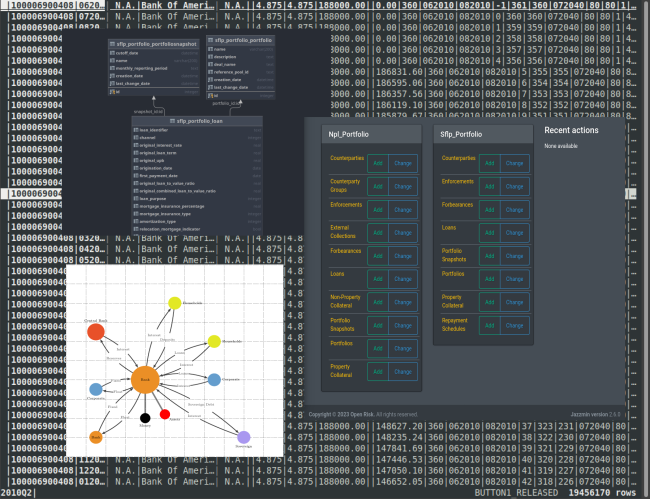

What do we mean by credit data? This post is a discussion around mathematical terminology and concepts that are useful in the context of working with credit data, taking us from network graph representations of credit systems to commonly used reference data sets

Course Objective

Digging into the meaning of credit data collections, the logic that binds them together towards understanding what they can be used for and what limitations and issues they may be affected by, this new course in the Credit Portfolio Management category explores a new angle to look at an old practice.