Version 0.2 of the Open Risk API incorporates the standardized EBA portfolio data templates

Extending the Open Risk API to include the EBA Portfolio Data Templates

The Open Risk API provides a mechanism to integrate arbitrary collections of risk data and risk modelling resources in the context of assessing and managing financial risk. It is based on two key technologies of the modern Web, RESTful architectures and Semantic Data.

OpenNPL, the credit portfolio management platfrom we launched recently fully integrates the latest versions of the Open Risk API. A very exciting recent development has been the release by the European Banking Authority(*) of a detailed specification (schema) for the exchange of credit portfolio data. This scheme has already been incorporated in the backend databases utilized by OpenCPM and an Docker image is publicly available.

(*) Open Risk is not affiliated in any way with the EBA

Open Risk API v0.2

The API is oriented towards programmatic use by client applications. The description focuses on human readable representations that convey the essence of the API. Only the new elements associated with the EBA portfolio data templates are discussed

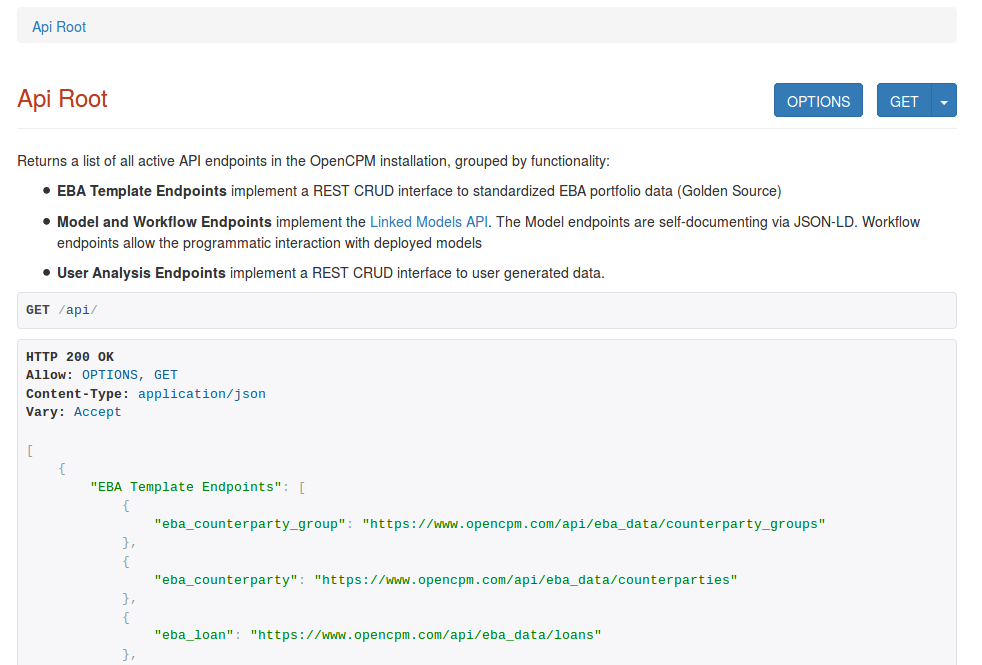

API Root

The API root is accessible at https://www.openriskmanagement.com/dashboard/api/. (An account is required to access the endpoint with a web browser or from a terminal via a token). Endpoints are grouped according to functionality, with all EBA data endpoints grouped under the eba_data endpoint.

EBA Data Categories Endpoints

The API exposes all eleven distinct data categories of the EBA templates. For brevity we only document here three of the

core data categories (Counteparty, Loan, Property Collateral). These categories apply to both performing and non-performing exposures and form the backbone of any credit portfolio management database.

Each one of the data categories is available under the API root, e.g https://www.openriskmanagement.com/dashboard/api/eba_data/counterparties, https://www.openriskmanagement.com/dashboard/api/eba_data/loans, https://www.openriskmanagement.com/dashboard/api/eba_data/property_collateral

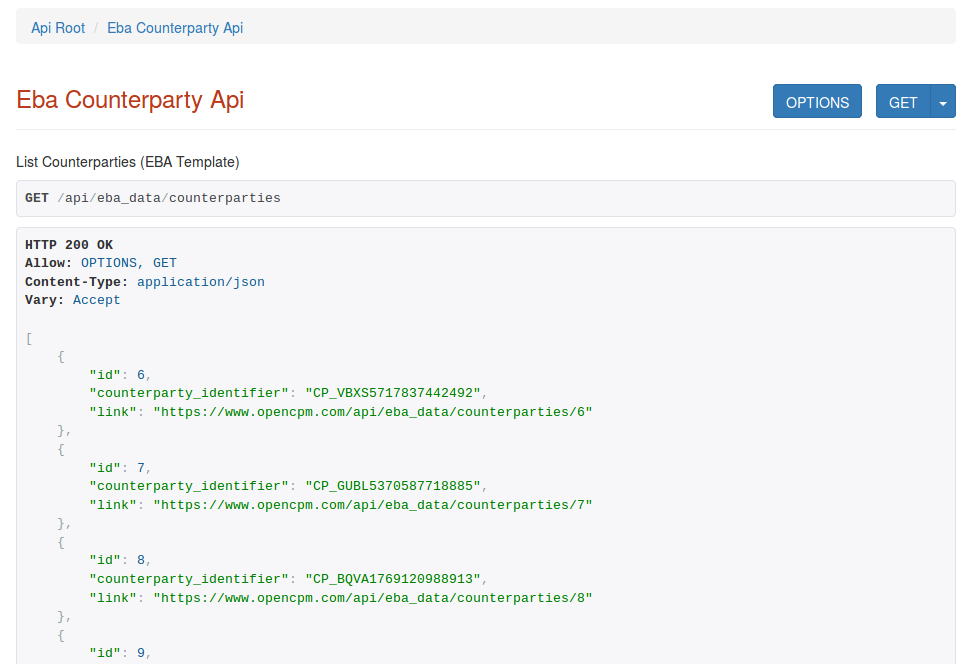

EBA Counterparty Endpoints

Starting with the counterparty endpoint, we get a list of all stored counterparties. The data returned (in JSON format) provide identification and links to individual counterparty data (Obviously all data display here are ficticious).

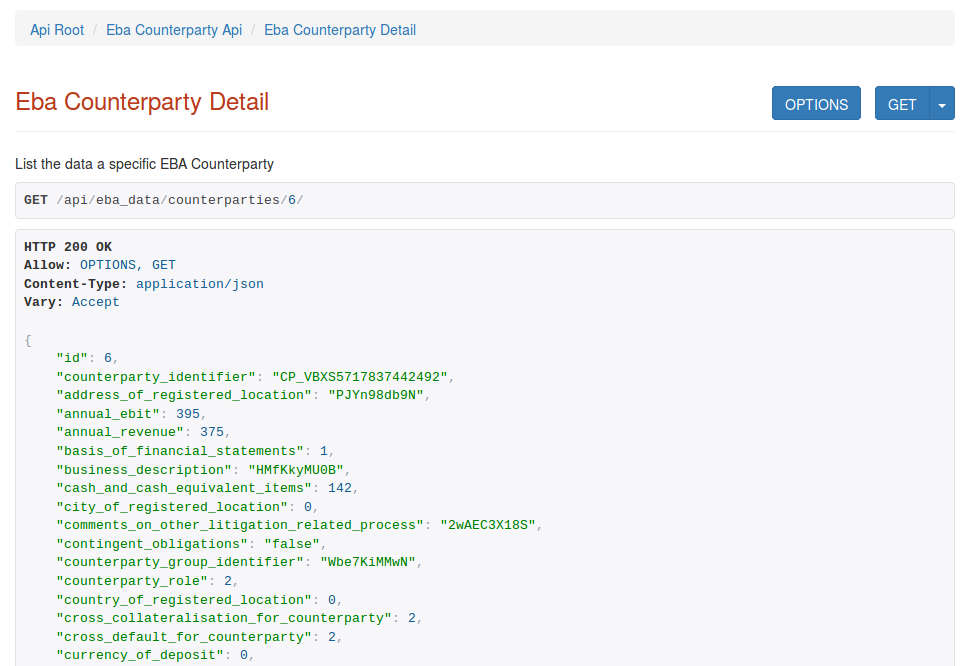

Following the provided link we get the detailed data per counterparty

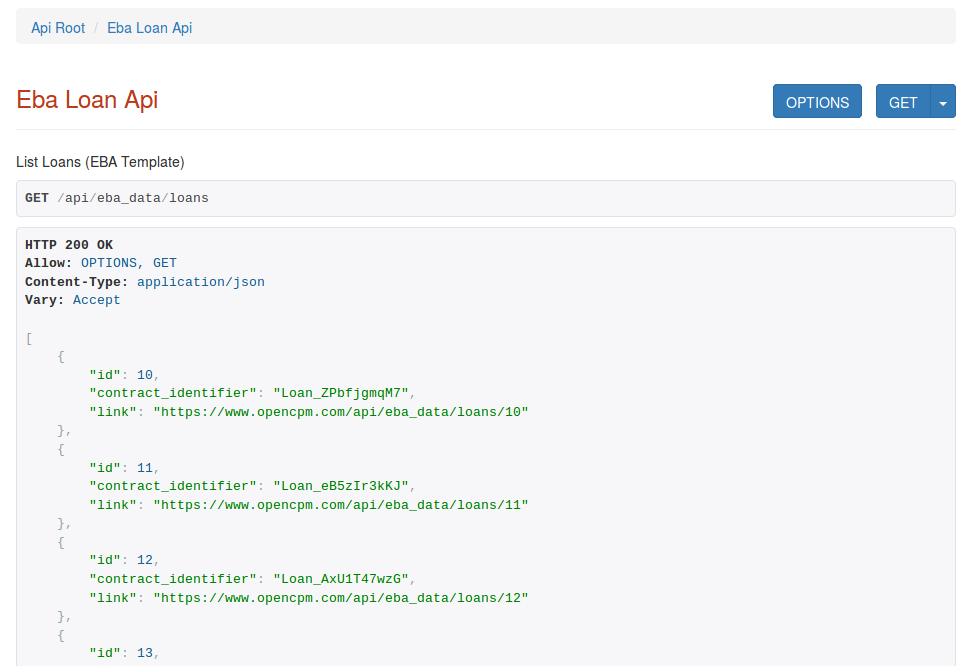

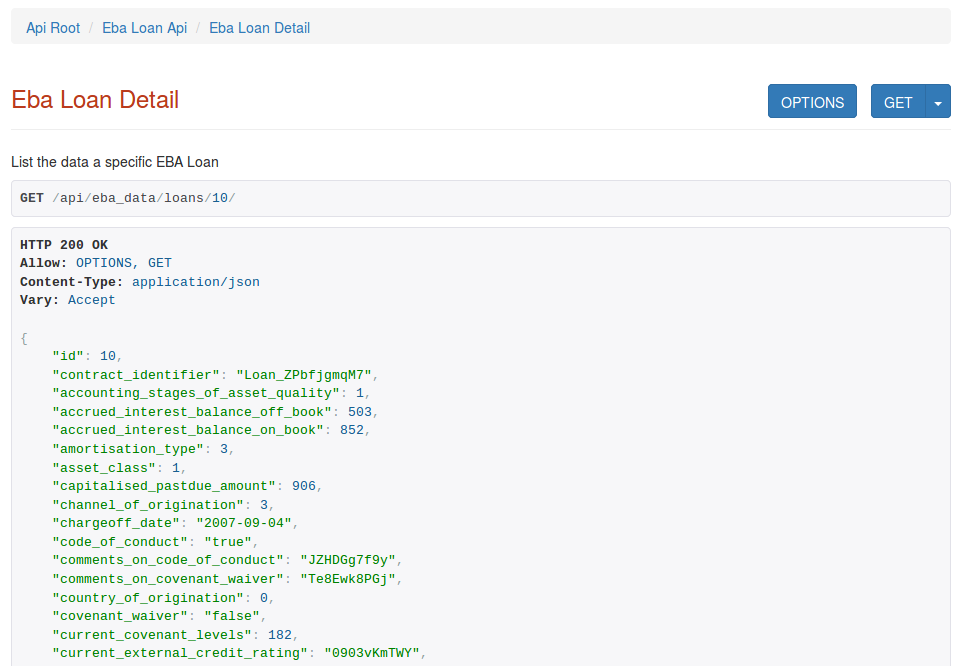

EBA Loan Data Endpoints

The Counterparty endpoint does not provide any information relating to loan or other credit products held by the client (borrower) or counterparty. The information is served primarily via the EBA Loan endpoint

The Loan details endpoint provides a large amount of data that complements the Counterparty data in supporting diverse portfolio analyses

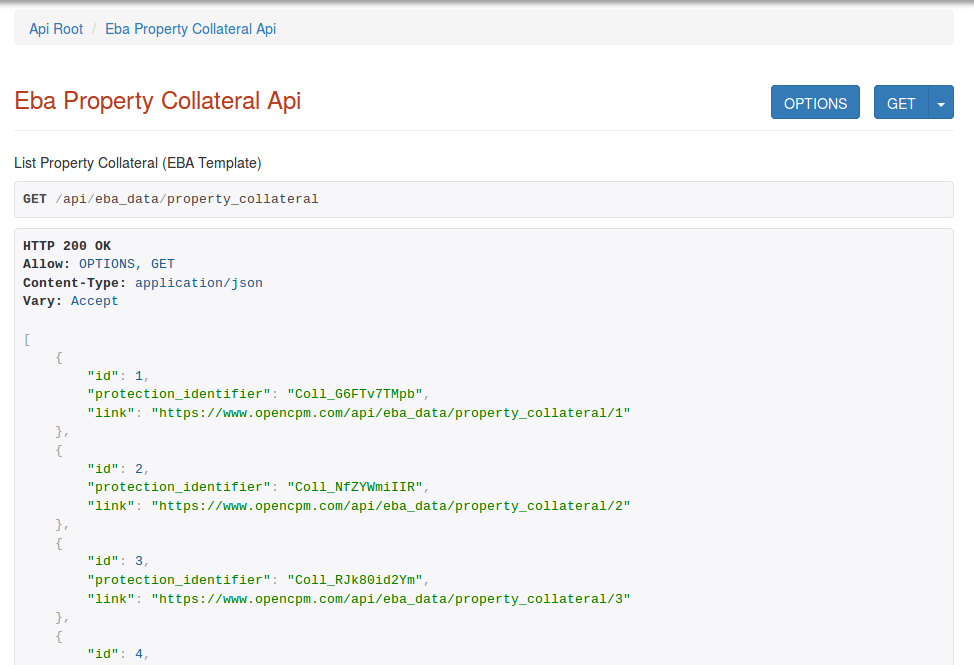

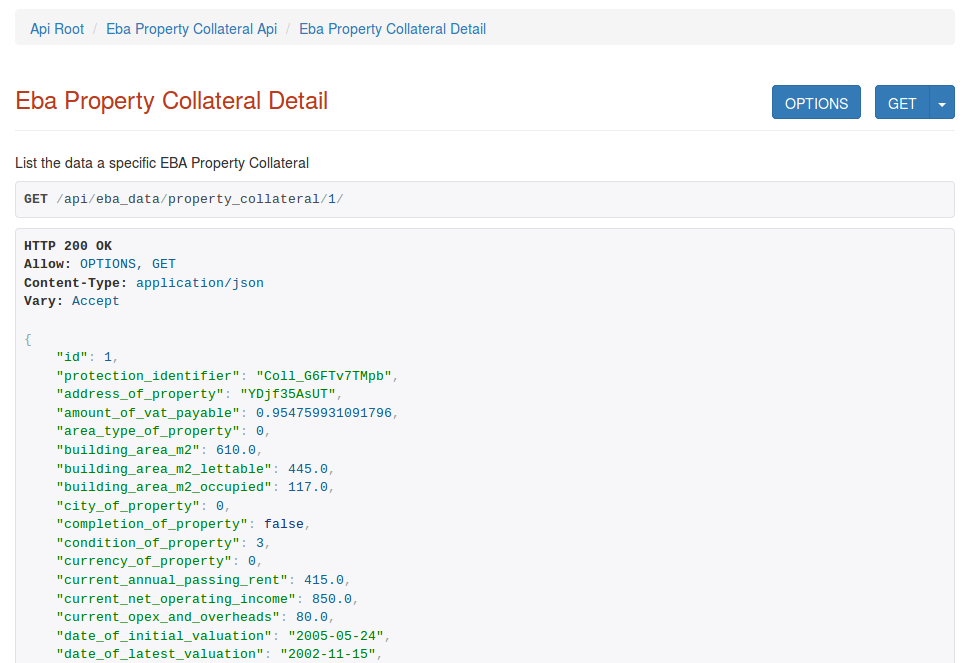

EBA Property Collateral Endpoints

When Loans or other credit products are covered by collateral (e.g. mortgages or other non-property collateral) it is essential for proper credit analysis to include such information. There are several relevant endpoints with the Property Collateral data being a common and representative use case.

The details provided in the Collateral endpoints vary by collateral type. For property collateral the type, condition and valuation of property play an importnat role

Comment

If you want to comment on this post you can do so on Reddit or alternatively at the Open Risk Commons. Please note that you will need a Reddit or Open Risk Commons account respectively to be able to comment!