Credit Portfolio Management in the IFRS 9 / CECL and Stress Testing Era

Credit Portfolio Management in the IFRS 9 / CECL and Stress Testing Era

The post-crisis world presents portfolio managers with the significant challenge to asimilate in day-to-day management the variety of conceptual frameworks now simultaneously applicable in the assessment of portfolio credit risk:

- The first major strand is the widespread application of regulatory stress testing methodologies in the estimation of regulatory risk capital requirements

- The second major strand is the introduction of new accounting standards (IFRS 9 / CECL) for the measurement and disclosure of expected credit losses While both Regulatory Stress Testing and IFRS 9 / CECL accounting require investment in analytic capabilities and provide unique new insights, both are aimed at satisfying evolving prudential or investor disclosure requirements. Neither is designed to help credit portfolio managers analyse and steer their portfolios in the bottom-up fashion that is an essential part their mandate.

The above developments are overlaid into pre-existing conceptual and practical frameworks such as

- Internal credit portfolio management tools used by firms

- The Basel II regulatory capital framework that crystallized such pre-crisis models into minimum capital requirements via the various Risk-Weighted-Assets formulas

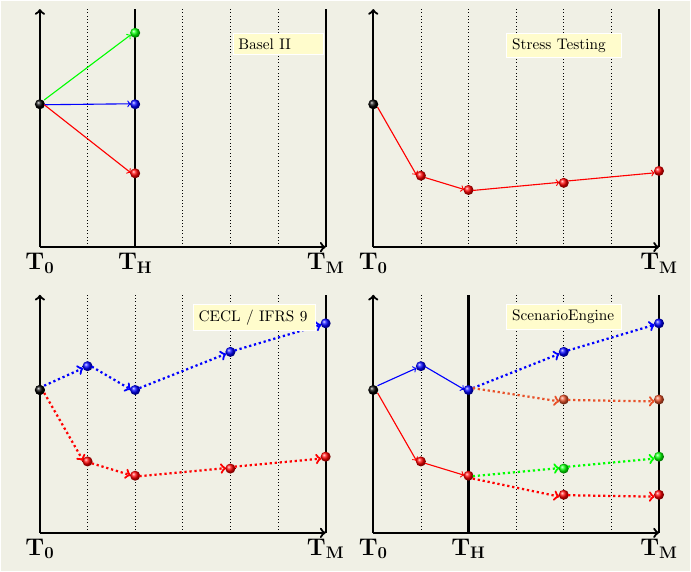

The overall relationship of the above can be depicted (in a simplified form) in the following diagram:

The Basel II world

The upper left panel captures the conceptual analytic framework that dominated credit portfolio management in the pre-crisis era. It is characterised by

- Large number of stochastically generated and probability weighted scenarios

- A relatively short risk horizon (typically 1-year)

- Stylized capture of residual risks post the risk horizon (e.g. using multipliers)

- The analysis of solvency at the risk horizon on a Gone-Concern basis

The Stress Testing World

The upper right panel captures the conceptual analytic framework that underpins the large scale regulatory stress testing exercises of the post-crisis era. It is characterised by

- Very small number (one or two) detailed macroeconomic scenarios / narratives without explicit probability

- A medium term risk horizon (typically 3-5 years)

- Focus also on residual risks

- Analysis of future solvency state using a (pro-forma) Going-Concern basis that uses future regulatory capital (Basel II) as input

The IFRS 9 / CECL World

The lower left panel captures the conceptual analytic framework that underpins the new accounting standard requirements for measuring and reporting expected credit loss. It is characterised by

- A small number of macroeconomic scenarios with explicit probability weights that must capture all eventualities

- A time horizon extending to full maturity

- Focus on estimating accurate current provisions and agnostic about any capital implications

The OpenCPM::Solstice Platform

OpenCPM is a new modern platform or credit portfolio management and tackles this multiplicity of frameworks head on and aims to provide a transparent and standards based solution.

A core module of OpenCPM is the Solstice. As implied by its name, this is simulation engine that is able to generate the scenarios and estimates required for analysing credit portfolios. The focus is on bottom-up credit portfolio management which is: a) aligned with the views generated by Stress Testing exercises and IFRS 9 / CECL reporting and b) enables proactive analysis of future developments as opposed to static current views.

This is achieved by:

- The ability to simulate macroeconomic scenarios with explicit probability weights

- A time horizon extending to full maturity

- A flexible risk horizon that can analyse ECL (provision) volatility and Going-Concern capital at any future timepoint