Towards a Faceted Taxonomy of Financial Services

In this post we are after a flexible financial services taxonomy that can help us understand both existing and evolving financial system developments. To this end we examine a range of existing classification systems and synthesize the salient requirements.

Who Needs a New Financial Services Taxonomy?

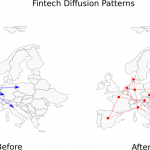

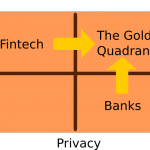

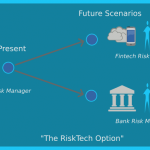

Our age is increasingly dominated by the dual challenges and opportunities of the sustainability transition on the one hand, and digital transformation on the other. We witness emerging new financial domains with novel names such as Fintech , or TechFin, or various combinations and hues of Green and Sustainable in Sustainable Finance and we see forces that are reshaping the direction of travel for the financial industry.