Open Risk API

Open Risk API

If you work in financial risk management you will most likely recognize where the following sentence is coming from:

One of the most significant lessons learned from the global financial crisis that began in 2007 was that banks information technology (IT) and data architectures were inadequate to support the broad management of financial risks. This had severe consequences to the banks themselves and to the stability of the financial system as a whole

For those lucky few risk managers not being affected by inadequate IT systems, the excerpt is from the Basel Committee’s Principles for effective risk data aggregation and risk reporting (2013). The document goes on to deliver a long list of principles on what kind of risk data qualities the esteemed committee deems sine-qua-non for financial institutions going forward. Alas, the wise heads didn’t tell us how to do it!

This has created a certain state of anxiety A fire sale is a condition where you are forced to unload assets under duress, at prices way below their “real” value. A fire purchase is the mirror condition. It happens when you are forced to buy equipment and/or services to cover up for embarrassing failures, at prices far above the real value of what you are acquiring.

What can be done?

One of the most profound messages from the technology sector is that even the best founded companies struggle to sustain large scale proprietary software systems (even Microsoft is giving up on this strategy). Read that again: The giants of computer tech, the wired people who eat chips for breakfast, would not dare operating their entire software infrastructure under a proprietary model.

The challenge of maintaining complex software is so big that only access to the widest talent pool, ability to look under the hood, peer review and other enabling ecosystem attributes of the open source style development can deliver viable solutions

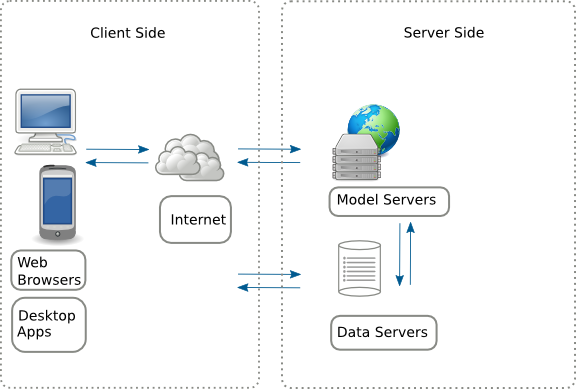

While open source models and data is a core element of Risk Measurement 2.0, it can only flourish if we can manage to coordinate loosely coupled risk methodology resources (models, data) across an organization (or multiple organizations), including possible proprietary legacy systems. We believe therefore that an API is an essential ingredient for an attractive open source ecosystem around financial risk models.

An API? What’s an API?

Wikipedia to the rescue:

In computer programming, an application programming interface (API) is a set of routines, protocols, and tools for building software applications

An API is a defined communication pattern between computer programs. Like: I will sent you my name first, my account number second. Programs that know the pattern can work together.

Risk Measurement 2.0 requires a communication language between risk models that pass around risk data. The good news is that the Web and the Internet offers us a hugely successful example of how to integrate computational resources (not to mention that it saves on costs to adopt what its already a popular technology and makes IT recruitment slightly less painful.

The Open Risk API provides a mechanism to integrate arbitrary collections of risk data and risk modelling resources in the context of assessing and managing financial risk. It is based on two key technologies of the modern Web, RESTful architectures and Semantic Data.

Want to Read More? or Play around with the API?

- Open Risk Open Risk API White Paper

- Open Risk Github Open Risk Github Repository