07, Risk Capital for Non-Performing Loans

Open Risk White Paper 7: Risk Capital for Non-Performing Loans

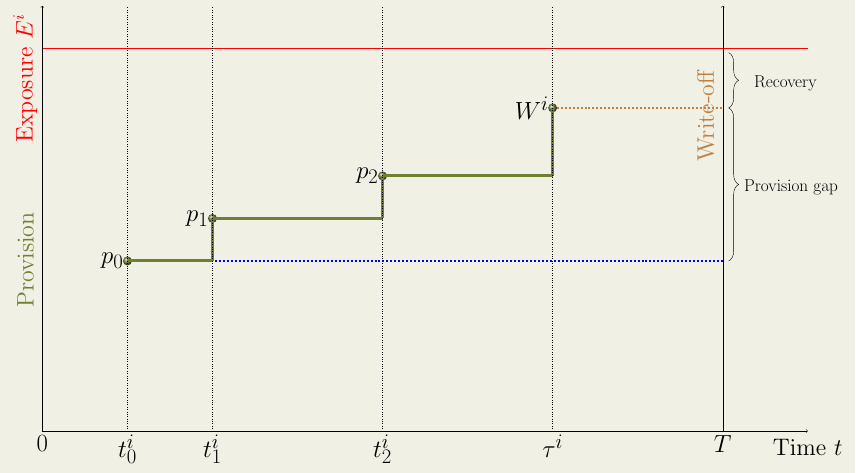

We develop a conceptual framework for risk capital calculation for portfolios of non-performing loans. In general banking practice, loans that pass a threshold of delinquency are declared non-performing and are provisioned. Yet there is a residual risk that the provisioning is not sufficient. This risk must be covered by capital buffers. The literature for risk capital requirements for NPL portfolios is very limited, which implies that Stress Testing and Internal Capital Adequacy Assessment (ICAAP) requirements for non-performing loans are harder to meet. Our framework builds on tools used in portfolio credit risk modeling and provides a structured approach to address the risk profile that is specific to non-performing loans.

Download

Citation

@ARTICLE{OpenRiskWhitePaper07,

authors = {P. Papadopoulos, J. Wang},

year = {2016},

note = {\href{https://www.openriskmanagement.com/wp-content/uploads/2016/02/OpenRiskWP07_022616.pdf}{Download URL}},

title = {{Open risk WP07: Risk Capital for Non-Performing Loans}},

journal = {Open Risk White Papers}

}

Comment

If you want to comment on this post you can do so on Reddit or alternatively at the Open Risk Commons. Please note that you will need a Reddit or Open Risk Commons account respectively to be able to comment!