Transparency, Standards, Collaboration and regaining trust in financial services

Transparency, collaboration key to regaining trust in financial services

In banking, confidence is the first order of business

Maintaining the confidence of market participants, clients, shareholders, regulators and governments is uniquely important for the financial sector. Trust is, quite literally, the real currency. Yet it is a truism that confidence is hard to build up and rather easy to destroy. Why is this so?

The short answer: The difficulty in rebuilding trust is linked to the lack of transparency. Let’s explain: When facing a proverbial black box, we resort to observing its response to external conditions in order to understand it. After a long time of observing we may finally get comfortable that we have mapped the inner workings. We do this by observing sequences of correctly predicted “stimulus-response pairs.

Once we reach this point of confidence, if we get a really discordant “wrong” response we are exposed as ignorant. Our confidence that we understood the algorithm inside the black box goes back to zero in a single instance.

The broader financial sector has send discordant responses that still reverberate in the consciousness of those affected. Regulators did go into post-crisis remedial overdrive, using whatever tools they had at their disposal to restore a working equilibrium. Obviously a meaningful amount of that elusive confidence elixir has been recovered. But so many years after the onset of the crisis there is an unmistakable, lingering, sour taste, expressed among others, in various damning public surveys. There are likely multiple reasons for this slow recovery. Some have probably nothing to do with the adequacy of risk management or other internal factors. But a key aspect of the problem is that:

One can never fully restore confidence by merely being compliant to external requirements

For a financial services provider being in compliance is the expectation. If we want somebody to notice, we need to excel, to exceed expectations. And if the lack of confidence is systemic, demonstrable excellence also needs to be broadly based rather than confined to a few exemplary institutions.

To go back to the black box analogy: If after a crisis the system reverts to giving “good” responses this will not eliminate the fear that it is only a matter of time before the disastrous wrong answer rears its ugly face again. Given this challenge, how do we build up the next level of confidence in risk management? The answer is, with hard work:

regain the initiative by investing into core risk management competencies and by clearly demonstrating that such initiatives lead to tangible improvements

It is in this second, “demonstration” challenge where non-trivial transparency and openness challenges kick-in. How does the outside world know that effective and permanent changes are in place?

The tale of a repentant car mechanic

Let’s imagine for a moment we are the owner of car repair shop. It has been known that our workshop was occasionally pulling fast ones with our customers: Replacing good working parts for no reason; Not following safe workplace practices, Bundling crappy, used parts inside good ones; Damaging unrelated parts by accident and keeping it secret; Overcharging; in short - the works.

At some point all this got discovered There was a big brouhaha which then sort-of-settled in an uneasy silence (being the only repair shop in town helped). We did promise to get down to seriously cleaning up our act. How do we go now about ensuring a smiling and confident thumps-up when the next serviced client walks away from our shop?

We should try some (or all) of the following strategies (feel free to add your own list of effective measures in the feedback!):

- Get all our mechanics certified at the toughest, not the minimum required level

- Disclose as much as we can realistically can about the work performed: Keep detailed logs of repairs, hold-on to the pile of discarded parts as evidence etc.

- Perform measurements that demonstrate fitness-for-purpose in actual as opposed to laboratory driving conditions

- Show all the above to our clients

Where are the opportunities for more transparent risk management?

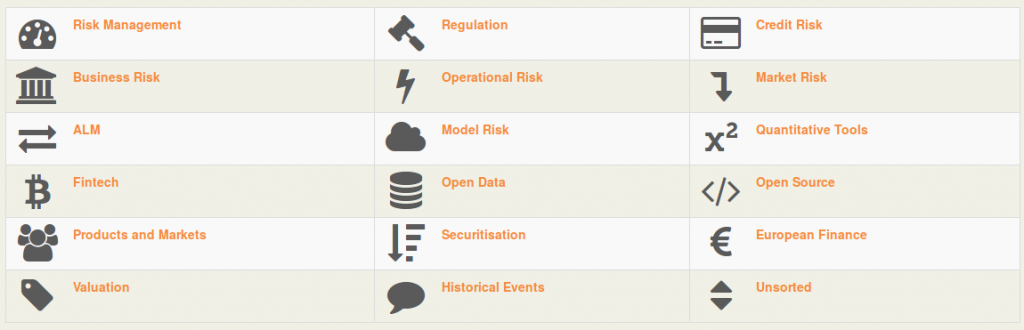

There are already obvious channels such as enhancing the regular reporting done by banks. We highlight three additional technical possibilities that provide a more rounded and forward looking approach:

- Adoption of Open Source, in particular around Risk Models

- Developing public Risk Management Standards

- Creating Collaborative Risk Management Knowledge Bases

Open Source and the Mind Share game

The largest and most tech-savvy companies have long realized that they must embrace open source software or face competitive disadvantages. One after the other all major technology players have rushed to open up their software toolkits. Why? One important objective is to cultivate around their platforms the mind share that is necessary for pulling through the difficult task of writing ever more complex software platforms.

Writing software that scales in usage and longevity is tough. Really tough. Point in case: The current software stack that powers the digital tech boom has taken almost fifty years to develop. Yet that long incubation profile is where the game is. An open source strategy mitigates at the same time the well known problems of legacy banking IT and achieves enormous transparency gains. Yet this journey will take time Risk managers need to be active stakeholders in the ongoing IT transformation of the financial services sector. They must try infuse the discussion with their own requirements, which are normally among the most demanding use cases within a financial services firm.

Open source strategies for risk management platforms will have a profound impact on the modernization, transparency and confidence of financial services

Risk Management Standards

Some areas of the financial industry have historically come together to develop common standards and protocols that benefit the industry (and ultimately clients). Alas risk management has not been a visible factor in such developments. This is an indication of the relative immaturity of the financial risk management profession. Namely, standards, norms and codified best practice are signatures of self-confident disciplines, not auxiliary cost functions.

Standards are intrinsically transparent

The technology sector has shown long term vision in this respect by working with (for example) the independent and non-profit W3C organization that develops global standards for the web. This enlightened strategy is underlying our current ability to access any internet resource from almost any computer (in the old days Microsoft had opted not to play along with standardization, in the hope of imposing its own platform. Luckily it failed).

Collaboration can be the rational choice

How many risk managers google the internet daily for information and end up in a Wikipedia page?

Hard and fast statistics are hard to come-by but it is likely a very large fraction. The net has become an essential extension of any knowledge worker’s toolkit and that includes risk management. Yet while Wikipedia is an excellent general knowledge base once you dig into technical details, it can be very incomplete. When that is the case, the main reason, usually, is that nobody with the requisite knowledge has volunteered depositing detailed information onto its collection of public articles.

Creating a private (internal) organizational “wiki” to capture the firm’s own expertise is easy enough and quite frequently done in larger firms. But for all but the very largest institutions such a tool will likely face a shortage of contributors in some areas and will go stale without dedicated resources. When it comes to documenting the technical details useful for risk management, fragmentation of available resources is sub-optimal, as nobody has critical mass for the task.

Collaboration is in this case the rational choice and it will help achieving an essential and visible upgrade to the risk manager’s toolkit.

Open Risk Manual

As a prime example of collaborative development of public risk management standards and knowledge base we sponsor a public wiki, a specialized Wikipedia for risk managers.