Using the Kraljic Matrix in Green Public Procurement

In this post we discuss on the possible uses of Kraljic Matrix concepts in the context of Green Public Procurement

Motivation

Sustainable Public Procurement involves significant complexity and implementation barriers as it involves diverse categories of products and services, each with their own specific sustainability and knowledge requirements. It also requires augmented organizational capacities to handle expanded information flows that provide more holistic views on market capabilities and supply chain interdependencies.

As a small sample, the following table lists the most used CPV codes in 2024 in Dutch public procurement

| CPV Code | Description | Percentage |

|---|---|---|

| 79000000-4 | Business services; Legal, marketing, consulting, printing, and security services | 23.5% |

| 45000000-7 | Construction work | 9.6% |

| 71000000-8 | Architectural, construction, civil engineering, and inspection services | 6.2% |

| 72000000-5 | IT services: consulting, software development, internet, and support | 6.0% |

| 90000000-7 | Wastewater, waste, cleaning, and environmental services | 5.8% |

| 77000000-0 | Agriculture, forestry, horticulture, aquaculture, and beekeeping services | 5.0% |

| 34000000-7 | Transportation equipment and related products | 3.5% |

| 85000000-9 | Health care and social work | 3.3% |

| 30000000-9 | Office machinery and data-processing equipment, office equipment and supplies | 3.3% |

| 50000000-5 | Repair and maintenance services | 3.2% |

Identifying tools and practices that can help manage some of that complexity is thus of obvious importance. One such tool is the Kraljic Matrix (KM) methodology. It is management tool used in organizing supply chain management and procurement activities of (usually) corporate entities. The original proposal goes back to Kraljic and an 1983 article called Purchasing Must Become Supply Management, published in the Harvard Business Review. The main trust of the methodology is to categorize and prioritize procurement activities in a systematic and well-defined manner. Since then there has been substantial literature and many variations on the theme.

In this post we want to review and discuss potential applications specifically in the context of Green Public Procurement, and even more specifically addressing the GHG emissions footprint of public procurement activities. Such specialized application of the KM concepts has been less trodden territory.

First, a refresher on Classic Kraljic

A high level summary of the KM methodology as it is typically applied in corporate procurement context would read as follows:

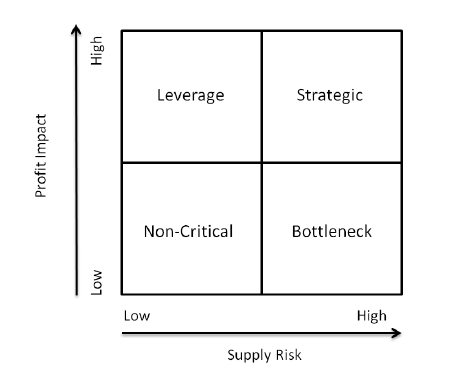

Group together and score potential procurement activities along two key dimensions. Firstly, assess the importance of the purchasing activity to the organization using some type of economic value metric (for example profit, total cost etc.). Once that characterisation is available, lay out the scores of the different procurement activity groups along the vertical axis on a graph, with low importance at the bottom and high importance at the top. Next, examine the supply risk associated with these procurement categories, using again suitably defined indicators of supply risk. Use the horizontal axis to arrange categories from low risk on the left side to high risk on the right side. Schematically one then obtains the following dashboard:

The classic approach considers the pair of Strategic Importance alongside Supply Risk and identifies four distinct categories or quadrants of procurement activity:

- Strategic, namely categories with high-profit impact but also high-supply risk

- Bottleneck, those with low-profit impact yet high supply risk

- Leverage, activities with high-profit impact but low supply risk, and lastly

- Noncritical, those with low-profit impact, low-supply risk.

The intended utility of the KM construct is primarily diagnostic: reveal and attribute a certain character to groups of procurement activities, thereby helping manage pipelines more effectively. One such management intervention would be the differentiation of the style and resources dedicated to each procurement category. For example, the “leveraged” category may suggest that more intense engagement with the market (e.g., seeking more suppliers, looking to increase options and competition) might optimize the value impact (without undue supply risk). An alternative strategy, say building long-term relationships with trusted suppliers might be less relevant in for this category.

The economic impact of a given supply class can be defined flexibly, e.g., in terms of fractions of volumes purchased, or as a percentage of total purchase costs, or any other indicator of impact in business operations. Indeed, this flexibility is what will enable us to specify alternative indicators in the GPP context, as we will discuss below. On the other hand, supply risk (sometimes also denoted as complexity risk) can be linked to the depth of a product market (e.g., the number and quality of suppliers), the predictability of demand as seen in the historical track record, the available alternative procurement options, any substitution possibilities etc. Implicit in the KM methodology is a risk horizon, the period over which benefits and risks are considered. Clearly the intention of KM is to help shape of the overall procurement management process.

Generally speaking, the larger and more diverse the procurement portfolio (in terms of range of products and associated risks), the more valuable such heuristic approaches may be. Needless to say, the qualitative nature of the approach introduces substantial subjectivity in the scoring of suppliers and/or products in the various quadrants.

Aside on Financial Portfolio Theory

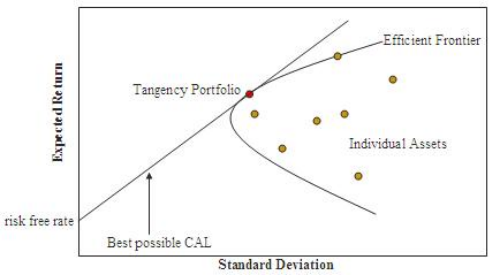

Ultimately the objective of KM tools is to have an informed and systematic reduction of costs and risks across the procurement portfolio. Readers with a financial background will undoubtedly notice the conceptual analogy of the above KM construct with so-called Modern portfolio theory (MPT), or mean-variance analysis. MPT is a mathematical framework introduced by economist Harry Markowitz back in a 1952. The core idea proposes to manage portfolios of financial assets such that their expected return is maximized for a given level of value risk. MPT is effectively a concrete quantification of diversification in investing. It uses readily available data from historical market price developments of various portfolio assets to establish the variance of return (the standard deviation) as a measure of risk.

The aspect of MPT that is important for us here is not the quantitative tools it uses but rather the core distinction between a vertical (impact) axis that is an expectation measure, and a horizontal (supply risk) axis that is an uncertainty measure, capturing uncertainty around the expectation.

This mindset leads naturally to the fundamental optimisation behind modern portfolio theory which aims to find the so-called efficient frontier, the best possible expected level of return for its level of risk.

In other words, the KM methodology is an invitation to integrate specific risk management considerations (supply risk) more systematically into the procurement process. With that frame in place we are ready to tackle the question: how can we apply the Kraljic Matrix methodology in a sustainability context?

Kraljic meets the Sustainability Challenge

In the context of (corporate) procurement the challenge of achieving long-term environmentally sustainable economic profiles has already led to the development of so-called of sustainable supply chain management (SSCM) methodologies 1, which are typically organized around the three ESG pillars. In the context of corporate procurement there is also a more specific Green Supply Chain Management (GSCM) concept. This is defined as the integration of environmental factors into supply-chain management. A Green Supply Chain considers aspects such as embodied Greenhouse Gas (GHG) emissions and other environmental impacts, as those result from product design, material sourcing choices, adopted manufacturing processes, all the way to delivery modes of final products and their end-of-life management. An example case study from the chemical sector is provided here 2.

While the above SSCM/GSCM management proposals concern the private enterprise, there is also active thinking on the relevance of the Kraljic Matrix tools for Sustainable / Green Public Procurement. Green Public Procurement (GPP) is defined as a process whereby public authorities seek to procure goods, services and works with a reduced environmental impact throughout their life-cycle when compared to goods, services and works with the same primary function that would otherwise be procured. The scope and objectives of GPP is thus appreciably different from corporate procurement objectives. It concerns public sector organizations with a wider range of stakeholders and integrates specific environmental mandates that include, for example incentivizing lead markets . Yet while these differences require adaptations to the classic Kraljic Matrix methodology, the underlying philosophy is still applicable and thus its potential usefulness in modified forms. In this spirit, a United Nations working paper 3 proposed a modified procurement portfolio model for managing sustainability risk and developed a set of propositions for procurement strategies to enhance sustainable public procurement (SPP). Their model followed the design principles of the Kraljic portfolio model and introduced adaptations towards sustainable public procurement practices.

The Kraljic Matrix can be thought of as a special instance of an SPP dashboard. In an important 2021 report 4 by the Dutch RIVM agency (National Institute for Public Health and the Environment) they illustrate such a dashboard focusing on Spend Impact Analysis. Plotting the spend volumes on the y-axis and the SPP impact possibilities on the x-axis results in a dashboard that helps analyse SPP impact. When comparing spend and impact, the quick wins become instantly visible, which makes prioritisation easier. For our purposes we’ll reserve the term Kraljic Matrix for dashboards where one dimension captures the uncertainly inherent in realizing SPP ambitions.

The meat behind MEAT

The first important aspect we must examine when considering the potential role of Kraljic Matrix type methodologies in GPP context (and our more specific use case of GHG emissions) is that the procurement agent is a public sector entity, therefore, while costs (and economic considerations more generally) are vitally important there is no financial profit motive. The impact (vertical) dimension of the matrix reflects the economic criteria on the basis of which contracts are awarded. The corresponding language typically requires that contracts are awarded on the basis of objective criteria: either the lowest price or the most economically advantageous tender (MEAT). Pursuing a MEAT objective means optimizing broader value for money, by assessing tenders against multiple factors beyond just cost. Possible additional such criteria may include:

- the full lifecycle costs of a product (no just purchase price)

- the technical merit of specifications, and more generally the quality of goods, services, or works (or price-quality ratio), including aesthetic or functional characteristics

- the delivery times, any after-sales service and technical assistance

- last but not least, the environmental characteristics (i.e., type and degree of positive or negative impacts)

Thus in MEAT objectives, price is considered alongside the range of other factors that are deemed relevant by the procurement authority (subject to conditions of relevance to the products being procured - but that is a separate discussion). In contrast to monetary indicators, these additional factors are evidently non-fungible in nature (an advantageous delivery time cannot be directly compared to any volume of emitted methane gas!). Thus, multi-criteria indicators must be weighted, in what becomes effectively a scorecard methodology. While scorecard construction methodologies are diverse, the following table illustrates the point:

| Criterion | Points | Weight |

|---|---|---|

| Price | 40 | 50% |

| Life Cycle Cost | 20 | 20% |

| Quality | 30 | 20% |

| GPP Profile | 10 | 10% |

The tender with the highest cumulative score against predetermined criteria is deemed the most economically advantageous. The optimization on the basis of the best price-quality ratio has become a commonly (though by no means universal) evaluation method among contracting authorities (in some countries the price-only criterion remains the dominant practice). The EU procurement directive (2014/24/EU) specifically requires contracting authorities to award the most economically advantageous tender using a price or a cost-effectiveness approach, such as life cycle costs or a price-quality ratio which should include environmental and social criteria.

From a conceptual perspective when thinking of the structure of a GPP adapted Kraljic Matrix methodology, we do not need to worry about the distinction between price-only versus multi-criteria MEAT objectives. Namely, a price-only approach can be considered as a limiting case where the MEAT scorecard places full weight (100%) solely on price. While obviously a “cost-only” approach creates significant bias and is not adequate towards realising GPP objectives, technically it can be seen as a specific weight selection.

Expected environmental impact of GPP criteria

A GPP Activity is any specific intervention singled out in the procurement contract (via GPP criteria) that targets measurable environmental impact. In other words, it has a concrete Effect, something that can be measured in a before/after calculation, where the before (or baseline) scenario is an estimated impact in the absence of the GPP criterion and the after is estimated impact from the application of the criterion. The precise mechanics of impact quantification depends on how environmental impact are calculated from data such as the volume and type of economic activity.

The expected performance (impact) of procurement activities that enforce GPP criteria leads to a quantitative indicator or score. E.g. in our example the GPP profile could be the tonnes of GHG emissions reduction resulting from the awarded works contracts. How such impact estimates can be integrated into an overall score varies. One approach is to evaluate such indicators with preassigned weights in the MEAT scorecard as per above allusion. Another approach is to attempt the monetization of such externalities: With instruments such as carbon pricing one may (in theory) integrate financial and environmental dimensions on a uniform basis. For our discussion the relevant requirement at this stage is to avail of a score that translates GPP policies to expected impact (and that this expectation becomes a material determinant in the selection of procurement contracts).

Defining GPP Risks

GPP Risk is, broadly speaking, the possibility that the objectives of a public authority in relation to its GPP program will not be realized, due to various uncertainties and unforeseen factors.

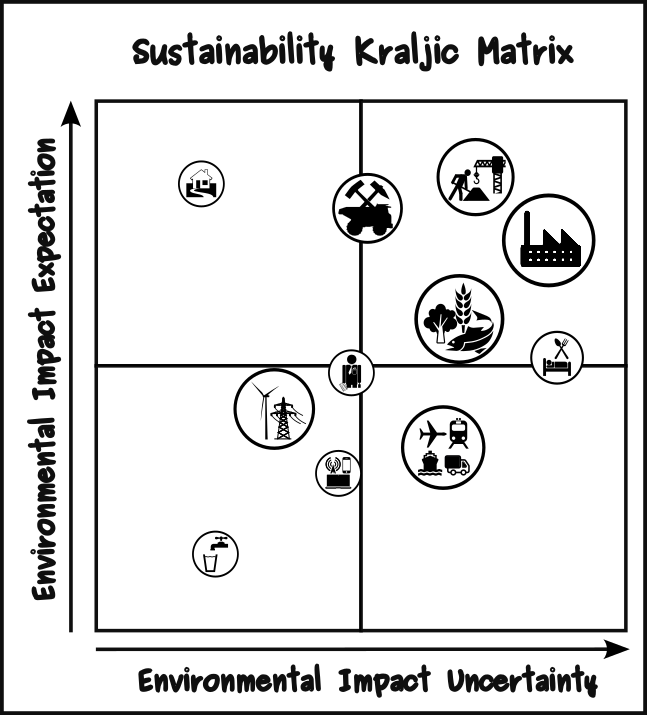

With the introduction of a risk dimension around expected GPP impacts we obtain a Sustainability Kraljic Matrix. This is a dashboard that highlights the benefit versus risk relation of a given set of GPP policies when applied to a portfolio of procurement activities. NB: While in principle uncertainty can spring both positive and negative surprises, it is customary in risk management context to focus on the effect of downside scenarios, namely the possibility that noble expectations and, with the knowledge of now, most likely outcomes will not actually materialize.

For consistency of analysis, the definition of GPP Risk in the context of a Kraljic Matrix must echo the definition of the GPP impact expectation. In other words, if a particular environmental impact feeds into the expectation part of the MEAT scorecard, it is the same effect that should also be considered on the risk side.

As an example, if the GPP criteria are projecting an expected GHG emissions reduction (and that reduction is integrated into a MEAT score as a weighted GPP Profile score), the corresponding risk assessment must capture the uncertainty around that reduction expressed also as a score.

If all goes well, the resulting tool will resemble the following (fictitious) situation:

The above diagram illustrates a hypothetical analysis where certain procurement activities are grouped by sector (construction, manufacturing, energy, transport etc. as indicated by NACE pictograms) are placed on a matrix of expected GHG reductions versus uncertainty of that reduction. The familiar four quadrants emerge again (reminder that the example is totally fictitious!):

- high impact interventions that carry high risk (construction works)

- high impact with low risk (housing)

- low impact with low risk (water services)

- low impact with high risk (transport)

With the core machinery now outlined we turn to the aspect that might be most unfamiliar, namely the assessment of GPP Risks.

Towards a GPP Risk Taxonomy

It is not our objective here to provide a complete GPP risk taxonomy but rather outline its shape. As with any Risk Taxonomy , it is important to distinguish between risk realizations, i.e., developments that impact the outcome and risk factors , the conditions or properties of the system that make risk realizations more likely (or more severe). In our example risks are all scenarios that produce materially different GHG reductions from what is assumed and planned-for in the GPP criteria. Risk factors are in contrast the characteristics of the relevant markets and supply chains.

Ultimately, what type of risks are in scope depends on the nature of procurement (e.g. the menu of CPV products ) and, critically, which of the environmental impacts are being prioritized by the procurement authority. For concreteness, we focus below on the case of GHG emissions. We are only concerned with risks that directly affect the stated organizational GPP objective (emissions reduction). This leaves out potential adverse events that can impact the organization via second-order effects, such as reputational damage.

Risk Types

A coarse-grained GPP Risk taxonomy might be along the lines of:

- Poor Performance of Contractors: Operational, business, financial etc. risks arising from the performance of direct counterparties to a procurement contract.

- Supply Chain Disruptions. Events that hinder the delivery of promised goods or services in the broader supply market of the contractors (e.g., geopolitical risks, market disruptions)

- Misreporting of Emissions. Unintentional or Intentional Errors in reporting emissions (inaccurate methodologies, faulty systems, greenwashing, fraud etc.) by any material contributor in the supply chain.

The outcome of any combination of the above is that while the procurement agent has “booked” a certain decarbonization trajectory over the course of the planning horizon, the outcome might materially deviate.

Risk Factors

Factors that may make the above risks more likely or severe might include:

- Technology Uncertainties: Uncertainty around the viability, market adoption and long-term sustainability (in the economic sense) of new technologies.

- Supply Chain Complexity. E.g., long supply chains, supply chains featuring important choke points etc.

- Limitations in knowledge, organizational capabilities and/or information technology maturity.

Discussion and Conclusion

The above overall scaffolding of a Sustainability Kraljic Matrix methodology can be implemented in various ways. GPP impact expectations and risks cannot be truly isolated from other concerns facing the procurement agent. Other potential environmental risks associated with the same procurement activities need to be considered. In principle this can be done by augmenting the two dimensions with additional respective measurements.

In the actual operations of the procurement agent a variety of other risks would be considered and managed on an individual contract basis. Such risks might materialize as discrete events. E.g. a major accident or a natural disaster, or as cumulative realizations over the risk horizon. Under the assumption of a large and diversified procurement portfolio, and for the purposes of the methodology it would be the systemic risk types that are more relevant. In other words, risks that may materialize across a larger number of contracts, over an extended period of time.

In certain contexts one can talk, at least in principle, about the capitalization of risk. This is effectively the conversion of future risk / uncertainty into a present risk premium. Is the the capitalization of the GPP Risk dimension at all meaningful? Practically this would require active markets for a rather esoteric type of risk. It would, for example, be visible in the premium required by a specialized insurance company to cover the downside scenarios where expected GPP impacts are not realized. In other words, given a certain procurement portfolio profile an insurance provider would compensate for any actual GHG reduction shortcomings versus those embedded as expectations in the award criteria.

In summary, the Kraljic Matrix is a long-standing methodology that helps organize and prioritise procurement activities which can be adapted in sustainability context. While conceived in the context of general commercial procurement by corporate entities, its core principle of pitching expectation against uncertainty are sufficiently relevant and flexible that they can also be applied in the context of Green Public Procurement. The resulting Sustainability Kraljic Matrix is a class of tools that can play a role in prioritising GPP activities in corporate and public procurement workflows.

-

Pagell, M., & Wu, Z. (2009). Building a more complete theory of sustainable Supply Chain Management using case studies of ten exemplars. The Journal of Supply Chain Management, ↩︎

-

Felipe Sanchez Garzona; Manon Enjolrasa; Mauricio Camargoa; Laure Morela, A green procurement methodology based on Kraljic Matrix for supplier’s evaluation and selection Online Preprint ↩︎

-

Carsten Hansen (UNDP) & Farid Yaker (UNEP), 2021, A Sustainability-weighted Procurement Portfolio Management. Online Access ↩︎

-

M.A. Steenmeijer et al., The environmental impact of EUR 85 billion in annual procurement by all Dutch governments: A study that helps to prioritise in sustainable public procurement (SPP). RIVM Report, 2021. ↩︎