Risk Capital for Non-Performing Loans

Currently many countries are drowning in bad credits

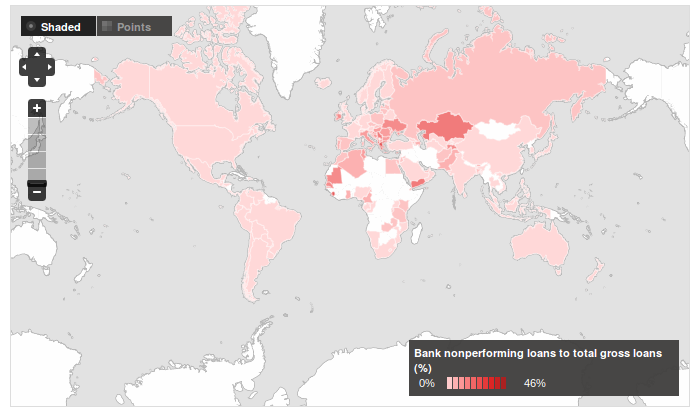

This visualization from the World Bank shows the current distribution of non-performing loans (NPL’s in short) around the world, as fraction of the total outstanding loans:

Translated in absolute numbers (according to IMF data) the European NPL book alone stands at around 1 trillion EUR.

As the adage goes, a trillion here, a trillion there, you pretty soon talk about serious money

The large NPL volume and the slow resolution pace of problematic loans means that existing NPL pools have become a significant risk factor that needs to be taken into account in tandem with the normal risks incurred in banking-as-usual (assuming there is anything normal in the current juncture).

The significance of residual NPL risk is acknowledged as much in the upcoming EU-wide stress testing exercise:

Stress Testing NPL’s in 2016 EBA stress testing round

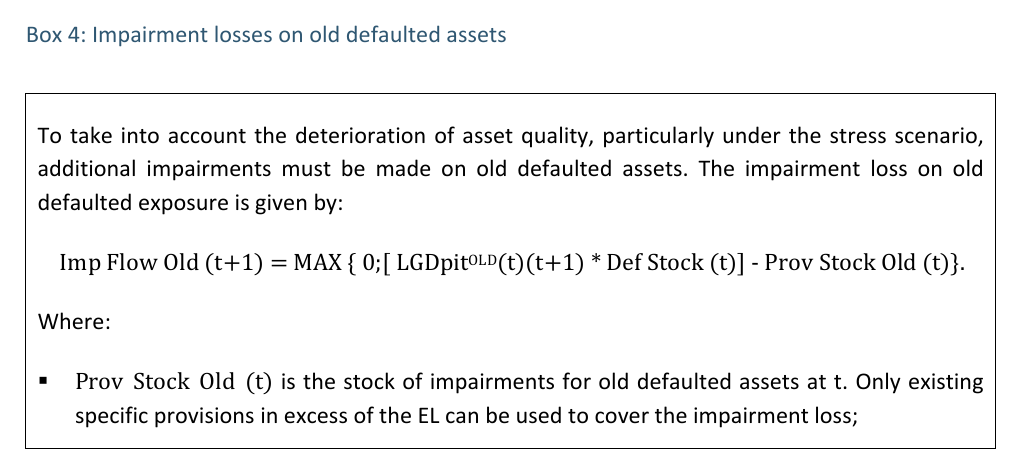

The European Banking Authority just launched the 2016 stress testing exercise. In the context of stress testing credit risk, impairment losses on old defaulted assets are explicitly singled out for calculation:

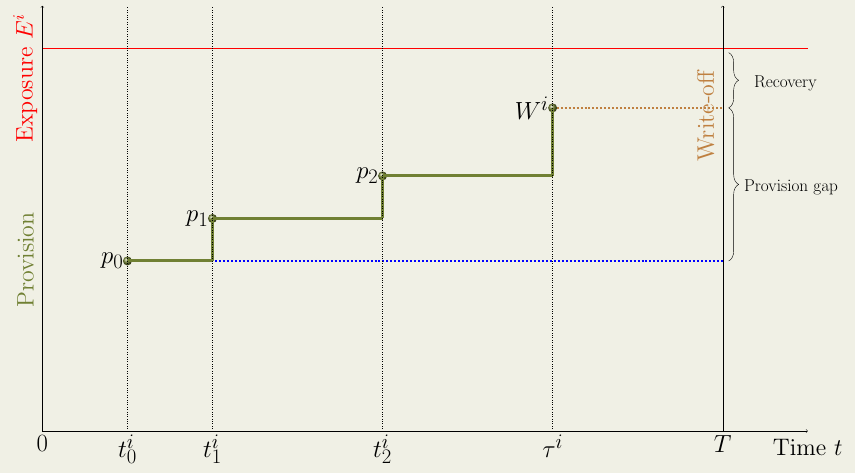

Hence it is very clear that there is a distinct need to be able to assess the risk profile of existing non-performing loans. So what are our options for this assessment?

Where are the frameworks of NPL Risk Management?

One might have expected that every aspect of the NPL risk profile would have been discussed theoretically, and best practice know-how for practical risk management would be widely available. This is certainly the case for the ex-ante credit risk analysis of a performing portfolio.

But in fact,

you would be hard pressed to find any published research around the residual risks associated with an NPL pool in workout!

Yet without accurate assessment of risk, it is hardly possible to make a correct assessment of risk-reward. Reward - in this context - being the decision to hold-on or not to the assets, and a fair sale price.

In line with the mission of Open Risk, we would like to act as a catalyst for improving the available risk management tools in this area. Please take a look at our latest Open Risk White Paper:

Risk Capital for Non-Performing Loans

As always, feedback and comments are much appreciated!