Unbundling the Banks: A How To Guide

Unbundling the Banks: A How-To Guide

Talk of unbundling the banks is all the rage these days (if we believe the chatter coming from fintech startups). Yet upon closer inspection one gets the feeling that these optimistic people might not necessarily know exactly what they are trying to unbundle, the true complexity of a medium-to-large bank, which in turn reflects, at least in part, the complexity of our modern Financial System .

A more petulant question is whether anybody knows how to unbundle a Bank , be it its own management or its regulators. We certainly know that it can be done, because it must be done when a bank fails completely.

In a bankruptcy scenario the firm must be dismantled piece-by-piece to its constituent business lines and assets which are sold away or otherwise disposed of. This is a process that can take years. Yet even this rather crude approach does not really solve our problem as we don’t want a body parts catalog of a dead bank, but a description of a living one!

Why bother with such unbundling questions? Well, one would think that understanding the bundle would also be help with its proper risk management, if that is what we want to do. While unbundling of business models is typically explored in terms of client segments and services provided, there are significant benefits to a risk based unbundling. It happens that being informed about what you try to risk manage helps a lot in stress situations. To wit:

You can certainly drive a car without any knowledge of how its made and how its systems interact. But riding down a long curvy downhill can be fatal if you don't know that the brakes are made of material that can overheat and lead to failure.

This post is an exploration of a risk-based unbundling of banking services.

The science of risk management starts with naming things

Risk managers, assuming they have enough time to get around to this type of question, would probably think of themselves as artists rather than scientists - the daily risk management grind is mostly about the art of the achievable. Yet our downhill brakes example suggests that a comprehensive knowledge framework about the components and workings of a bank, how they interact and how they might fail should be at least an aspirational target if we want to improve risk management.

So how do we get started with a scientific approach to the question of how the bank works? The history of science (similar to the cosmogonies of many peoples) suggests that in the beginning you have to go around naming things. Enumerating the visible components of what you are interested in and making lists and catalogs is the start of trying to make sense.

In the second step you start classifying, identifying similarities and differences, aiming to identify any common patterns that may suggest intrinsic linkages. After such linkages are hypothesized you need to test them empirically, possibly using mathematics for technical support. If your hunches turn to be true, you suddenly understand how your system works!

Can we apply this approach to risk management? Enumerating the components, classifying them and then finally trying to understand them? Some people have thought that yes we can

The Unfinished Risk Taxonomy

Man in the street: How far are we in the process for understanding the components and processes of a typical bank?

Philosopher: Only as far as regulators have pushed for this, in order to identify and, thus help manage, some of the key risks.

Man in the street: This surely can’t be true, people must know what they are doing in a multi-trillion industry?

Philosopher: If they do, they certainly keep it to themselves and don’t write much about it!

Man in the street: Right. So what is the regulatory minimum?

Philosopher: Regulators typically look at all the historical causes of significant losses, and they classify them under market, credit and operational risk.

Man in the street: And what about the recent liquidity and conduct risks?

Philosopher: Aah, those are being added as we speak.

Man in the street: There must be a better way than just wait for the next calamity!

Philosopher: Yes, it’s called Enterprise Risk Management, or Holistic risk management .

Man in the street: Interesting. So why isn’t this discipline getting more attention?

Philosopher: That is a very good question!

How to conceptualize a financial services firm

The blind men and elephant metaphor is very apt for describing available partial descriptions of a bank (or other financial services firms). Here is a list of partial ways of thinking about what constitutes the banking bundle:

The bricks and mortar view: This focuses on the glass tower buildings, the people, the computers etc. The very evident problem with this view is that it is not capturing what is going on inside banks from our perspective. A firm can go bankrupt with little physical evidence to show for it - besides possibly some employees leaving the building with cartons full of personal belongings. On the other hand physical disasters can certainly put the bank at risk, so this view must be part of our holistic, true, view.

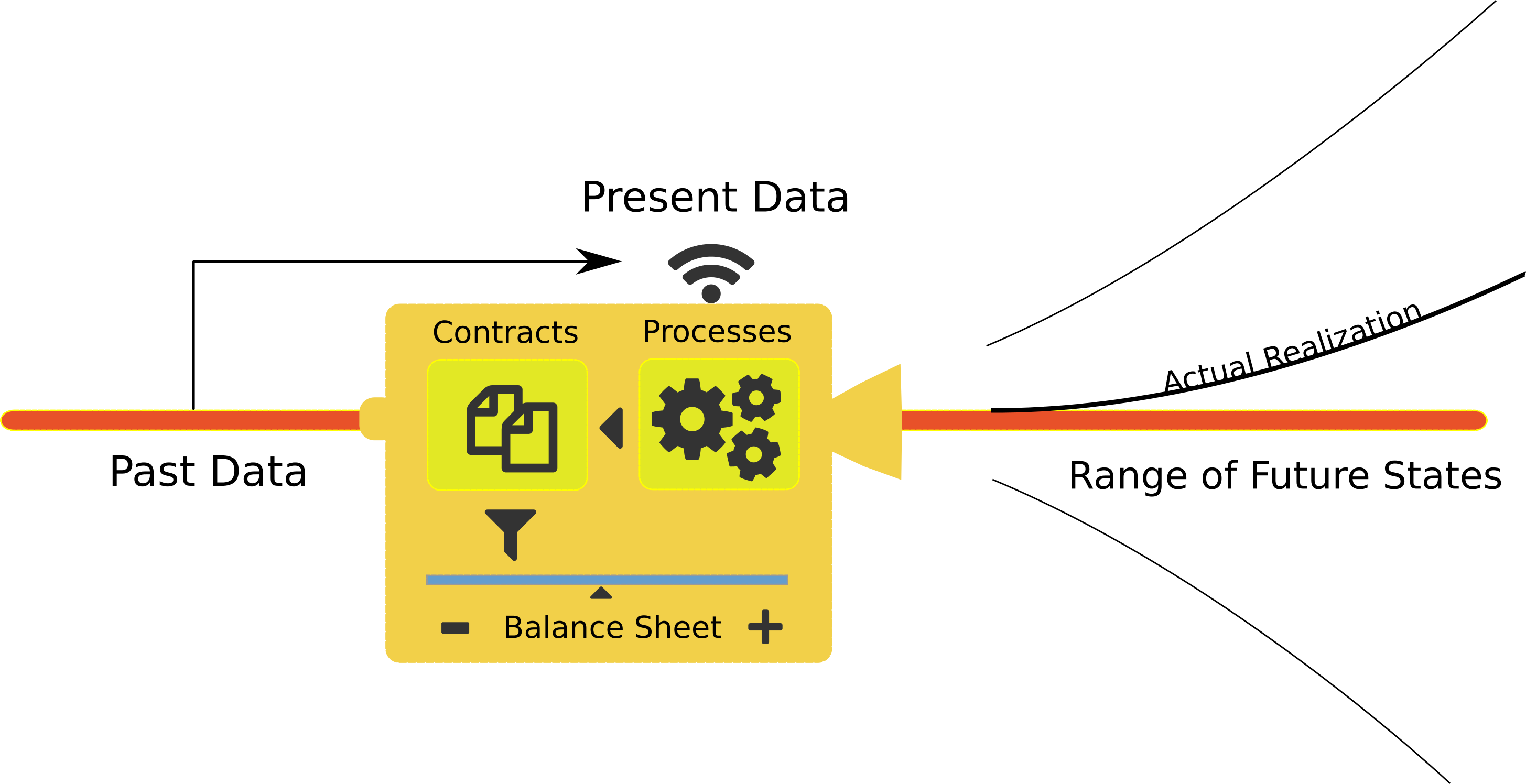

The balance sheet view: This is a powerful paradigm as the balance sheet aims to capture all significant contributions to the firm’s monetary value. There are two problems with this:

- Problem 1: There are more risky elements to a firm than what is captured in present value (e.g. the ethical standards and moral values of its people would typically not figure as balance sheet items)

- Problem 2: The same present value of an asset or liability can evolve into very different future states. A fixed swap contract and, e.g., a stock option may have the same value at some time but will in general lead to different future values, because they are revalued differently in different future states

The contracts view: Fixing problem 2 requires constructing a more detailed legal contracts documentation database that would aspire to capture the full extent of the firm’s current business - to the degree that is captured in legal documentation. Once we have this database, in a machine-readable form, the risk in different states of the future can - in principle - be assessed in an integrated manner.

How about Problem 1?

The information processing view: Complementing the contractual picture of the firm with less rigorously defined elements leads us to focus on identifying core business processes and describing them as carefully (and insightfully) as possible, with a focus on the human factor (the role and incentives of any people involved).

Indeed, we may think of the bank as a collection of information processing units where a number of business processes interpret economic data flows and convert them in tangible contracts (assets or liabilities).

Where to next?

Unbundling the banks (and developing true and holistic enterprise risk management of the financial system) will be a long journey. Here are some tools to help you along if you are interested.

- A white paper on Risk Taxonomies

- An online platform that helps you understand the risk taxonomy and even contribute your views to the Risk Manual (if you want!)