Open Risk Mentoring GSOC 2021 Hydra Nextgen API Project

For the Google Summer of Code 2021 season Open Risk is happy to join forces with the Hydra Ecosystem to mentor a student project that aims to build a hypermedia enabled REST service around standardized credit portfolio data

A GSOC 2021 summer project collaboration between Open Risk and the Hydra Ecosystem

Summer is underway and for the Google Summer of Code 2021 season Open Risk is happy to join forces with the Hydra Ecosystem. The project aims to guide students to build a hypermedia enabled REST service around standardized credit portfolio data. More specifically the project will build a REST service as backend for a hypothetical banking entity that collects and disseminates credit portfolio data conforming to an established public standard (the EBA NPL templates, see below).

The use of the full specification of the REST architecture (including hypermedia) showcases the advantages of a well-developed REST API (Linked Data) and its potential role in the digitization of banking IT. The use case is, e.g., a bank, a peer-to-peer lender or an asset manager holding a portfolio of loans. One or more databases contain data about borrowers, loans, credit risk assessments, forbearance, collection or enforcement data and other relevant information describing the portfolio. They aim to provide convenient and standards conforming access to allow other parties (investors, rating agencies, regulators etc.) to gain access to certain facets of the portfolio data, e.g., for due-diligence, valuation or other risk management purposes.

The project provides the Hydra community with useful architectural/engineering feedback and a working example to show functionalities and capabilities.

Context for the Project

Modern API designs are being rapidly adopted in the banking industry across the entire stack, sometimes denoted as the long overdue digital transformation of the industry. Well known is the consumer / front-end oriented set of Open Banking API’s, for example new data exchange API’s developed in connection with the PSD2 Directive but equally important is the drive to define, standardize and deploy in modern cloud infrastructure the entire backend of banking services. A notable standardization initiative in this respect is BIAN (Banking Industry Architecture Network) which illustrates also the challenge of capturing and documenting the requirements of what are very detailed and complex domains. The process of defining and implementing the complex stack of banking services as an API is still incomplete for a variety of reasons: legacy monolithic IT infrastructure, the proprietary nature of banking back-ends, complex business models, high regulatory scrutiny, lack of open standards etc.

EBA NPL Templates

European Banking Regulators promote standardization of credit risk data (and in particular NPL data) to remove frictions and risks from the European financial system. A significant initiative and development are the EBA Non-Performing Loan Templates, see also the corresponding EBA Excel sheets and documentation

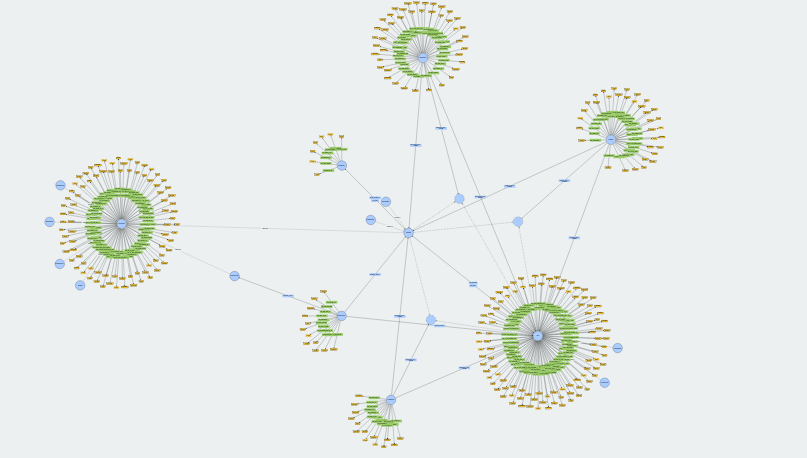

the NPL Ontology and Standardization of Credit Portfolio Data Exchange

Building on the regulatory recommendations, the Non-Performing Loan Ontology is a framework that aims to represent and categorize knowledge about non-performing loans using semantic web information technologies. Codenamed NPLO, it codifies the relationship between the various components of a Non-Performing Loan portfolio dataset. You can read more about NPLO here.

The Hydra Ecosystem

What is Hydra? Hydra is a documentation framework that is based on established Linked Data (Semantic Web) tools to build the next generation of connected Web APIs. A team of developers in the community aims to establish an ecosystem of tools to make Hydra framework operational. The motivation for Hydra from the Hydra project repository is quite clear:

Building Web APIs seems still more an art than a science. How can we build APIs such that generic clients can easily use them? How do we build those clients? Current APIs heavily rely on out-of-band information such as human-readable documentation and API-specific SDKs. However, this only allows for very simple and brittle clients that are hardcoded against specific APIs. Hydra, in contrast, is a set of technologies that allow to design APIs in a different manner, in a way that enables smarter clients.

The current Hydra specification is available in the Hydra Core Vocabulary

Follow the student code development and reports

In this evolving and promising backdrop, the GSOC 2021 project uses the European Banking Authority Loan Level Templates, the Open Risk NPL Ontology, the Hydra specification and the previous tools developed by the Hydra Ecosystem as a basis for defining the relevant data domain and delivering a conforming REST API.

- The repository of the Hydra Ecosystem automating REST APIs and delivering the next generation API clients.

- The GSOC 2021 project proof of concept is developed here

Further Resources

Further resources to get a feeling for the NPL / Credit Data domain and how you can make a difference using open source tools and modern API’s.

The openNPL project

The GSOC 21 project complements the openNPL platform an open source project released by Open Risk that provides a database backend to collect and expose loan data portfolios. The project is using Python/Django (and in particular the Django Rest Framework).

Open Risk Academy

Open online courses are available the Open Risk Academy that has courses relevant of the project. Here is a selection of the most relevant (there are more courses for those who want to get exposure to banking / risk management topics)

Comment

If you want to comment on this post you can do so on Reddit or alternatively at the Open Risk Commons. Please note that you will need a Reddit or Open Risk Commons account respectively to be able to comment!