Stressing Transition Matrices

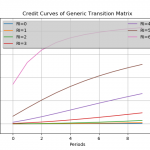

Release of version 0.4.1 of the transitionMatrix package focuses on stressing transition matrices

Further building the open source OpenCPM toolkit this realease of transitionMatrix features:

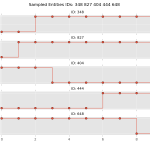

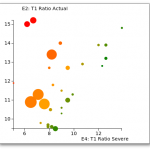

- Feature: Added functionality for conditioning multi-period transition matrices

- Training: Example calculation and visualization of conditional matrices

- Datasets: State space description and CGS mappings for top-6 credit rating agencies