09, Federated Credit Systems, Unbundling Credit Provision

Open Risk White Paper 9: Federated Credit Systems, Part I: Unbundling The Credit Provision Business Model

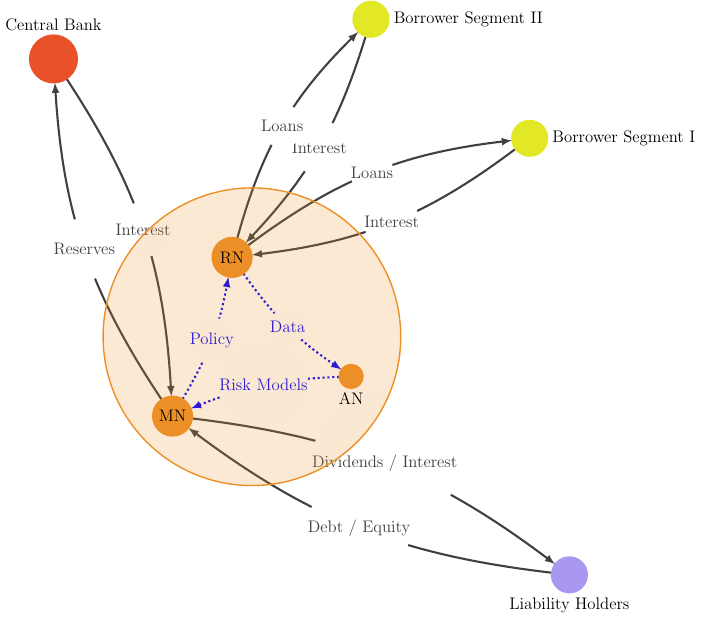

In this (the first of series of three) white paper, we introduce and explore the concept of federated credit systems. We review the rapidly developing fields of Federated Analysis and Federated Learning as already actively studied in the domains of medicine and consumer computing devices. This forms the backdrop for understanding the potential and challenges of applying similar concepts in finance and more particular credit provision. The context of modern banking is substantially different from the above-mentioned use cases. Understanding and shaping federated information systems to cater to its unique features and constraints (key added value, competitive landscape, regulatory frameworks) will help accelerate the adoption of new designs. Towards that purpose we construct a framework that conceptually unbundles the complex operation that is modern credit provision. We introduce a number of fundamental business entities (subunits) and their associated functions and discuss the underlying business models. We discuss, in particular, how and why they exchange data and metrics and the key risk management challenges of each. Finally, we sketch current architectures for credit information sharing with an overture to the new possibilities opening up with federation architectures.

Download

Citation

@ARTICLE{OpenRiskWhitePaper09,

author = {P. Papadopoulos},

year = {2020},

note = {\href{https://www.openriskmanagement.com/wp-content/uploads/2020/11/OpenRiskWP09_301020.pdf}{Download URL}},

title = {{Open risk WP09: Federated Credit Systems, Part I, Unbundling The Credit Provision Business Model}},

journal = {Open Risk White Papers}

}

Comment

If you want to comment on this post you can do so on Reddit or alternatively at the Open Risk Commons. Please note that you will need a Reddit or Open Risk Commons account respectively to be able to comment!