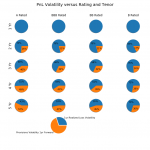

Credit Portfolio PnL volatility under IFRS 9 and CECL

Credit Portfolio PnL volatility under IFRS 9 and CECL

Objective

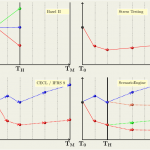

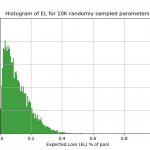

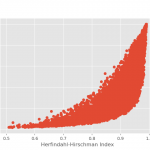

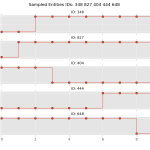

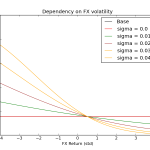

We explore conceptually a selection of key structural drivers of profit-and-loss (PnL) volatility for credit portfolios when profitability is measured following the principles underpinning the new IFRS 9 / CECL standards

Methodology

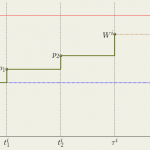

We setup stylized calculations for a credit portfolio with the following main parameters and assumptions: