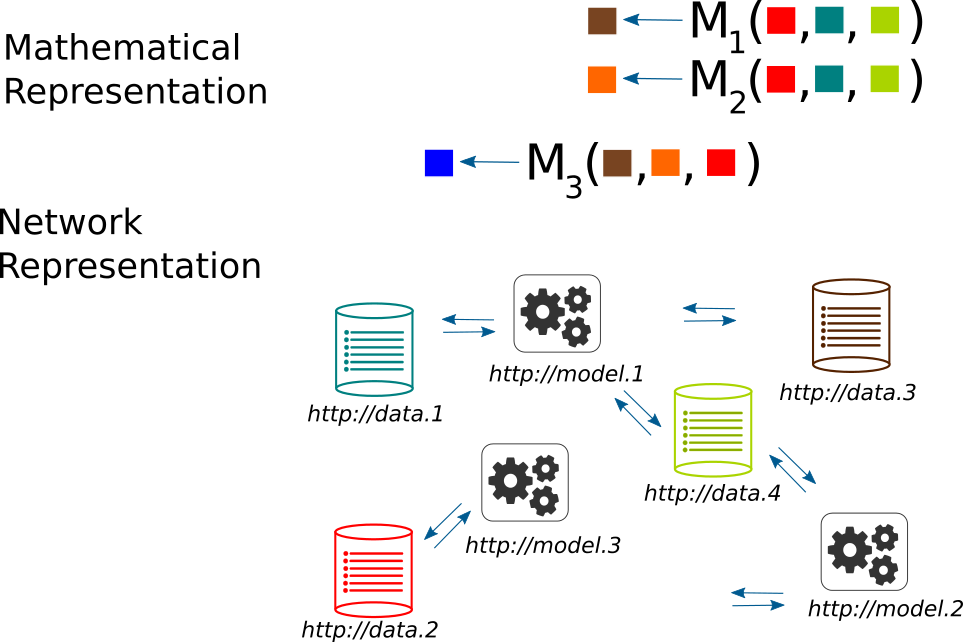

From Big Data, to Linked Data and Linked Models

From Big Data, to Linked Data and Linked Models

The big data problem:

As certainly as the sun will set today, the big data explosion will lead to a big clean-up mess

How do we know? It is simply a case of history repeating. We only have to study the still smouldering last chapter of banking industry history. Currently banks are portrayed as something akin to the village idiot as far as technology adoption is concerned (and there is certainly a nugget of truth to this). Yet it is also true that banks, in many jurisdictions and across trading styles and business lines, have adopted data driven models already a long time ago. In fact, long enough ago that we have already observed how it call all ended pear shaped, Great Financial Crisis and all.