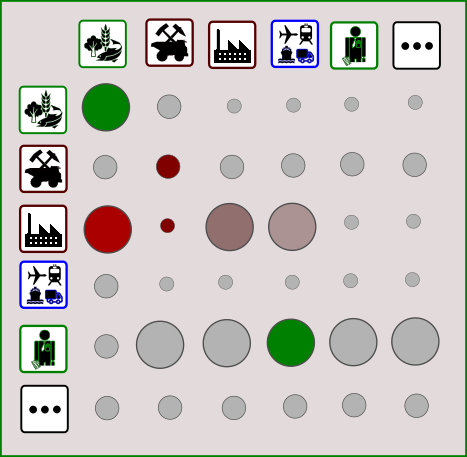

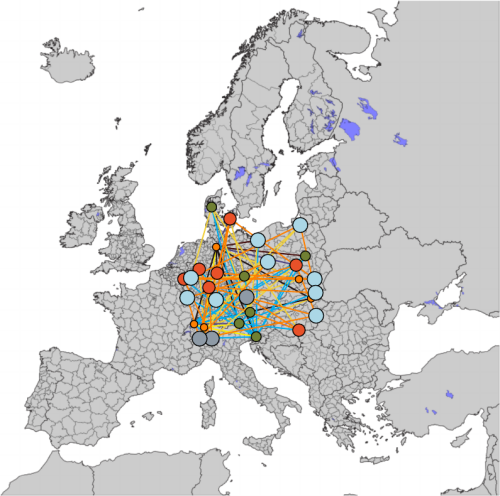

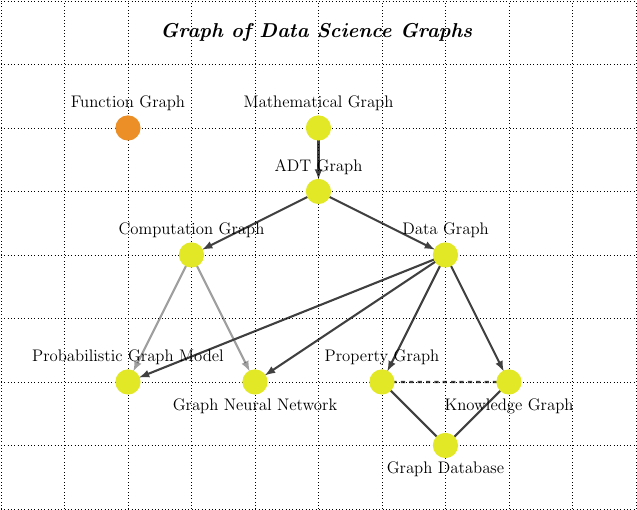

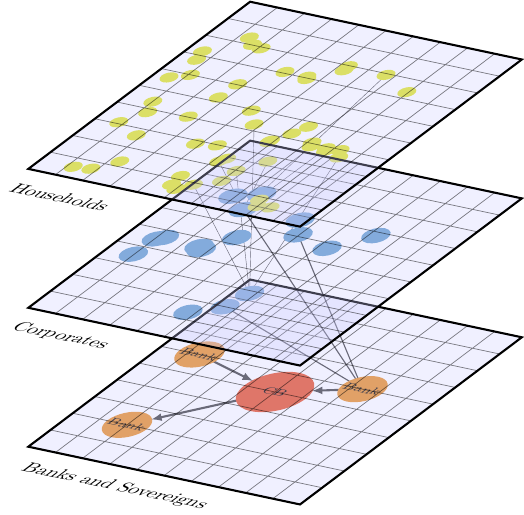

Environmentally Extended Multi-Regional Input-Output (EE-MRIO) tables describe economic relationships of economic actors (e.g. industrial sectors) operating within and between regions and their environmental repercussions.

An EE MRIO augments the more basic and historically first proposed Input-Output Models (IO) with additional datasets and/or modeling assumptions in order to provide insights into the environmental foorprint of economic activity. Presently, the emphasis on negative externalities of economic activity (e.g., climate change, biodiversity loss) turns EE MRIO models into a useful conceptual and analytic tool. Yet a good grounding on the underlying IO models is a prerequisite and this is the focus of this new course that is now available at the Open Risk Academy.