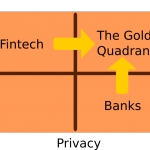

Transparency, Standards, Collaboration and regaining trust in financial services

Transparency, collaboration key to regaining trust in financial services

In banking, confidence is the first order of business

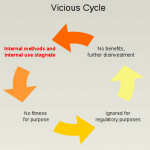

Maintaining the confidence of market participants, clients, shareholders, regulators and governments is uniquely important for the financial sector. Trust is, quite literally, the real currency. Yet it is a truism that confidence is hard to build up and rather easy to destroy. Why is this so?