List of Commonly Conflated Financial Terms

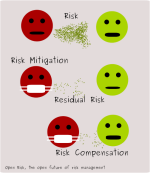

In this archive post we discuss a number of financial terms whose precise meaning is frequently intentionally or unintentionally obscured. As a result those terms may, like a Rorschach Blot, mean different things to different people. Unlike this famous psychological test, ambiguity in weighty financial matters can have adverse consequences.

According to wikipedia Conflation is the merging of two or more sets of information, texts, ideas, opinions, etc., into one, often in error. This may lead to misunderstandings, as the fusion of distinct subjects might obscure analysis of relationships which are emphasized by contrasts. Why does conflation happen in the first place? There are several possible factors which in some contexts may be co-existing and overlapping: