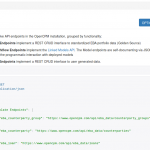

Version 0.2 of the Open Risk API incorporates the standardized EBA portfolio data templates

Extending the Open Risk API to include the EBA Portfolio Data Templates

The Open Risk API provides a mechanism to integrate arbitrary collections of risk data and risk modelling resources in the context of assessing and managing financial risk. It is based on two key technologies of the modern Web, RESTful architectures and Semantic Data.