An introduction to Semantic Python

A CrashCourse introduction to semantic data using Python covering a number of frameworks such as rdflib, owlready and pySHACL

This CrashCourse is an introduction to semantic data using Python.

Course Content

It covers the following topics:

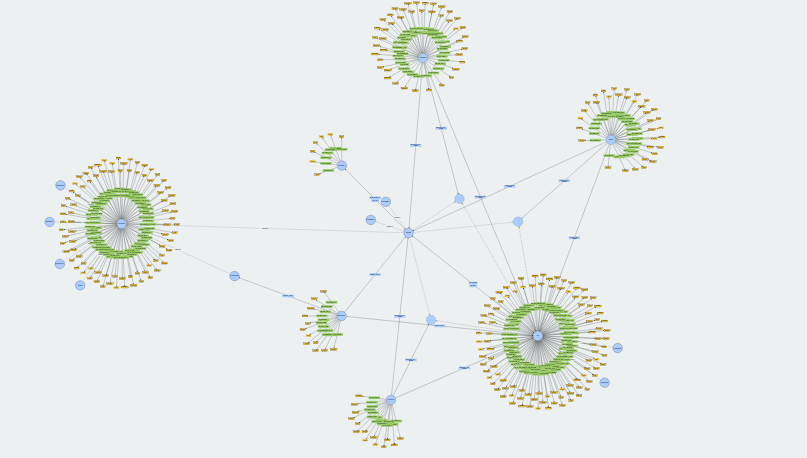

- We learn to work with RDF graphs using rdflib

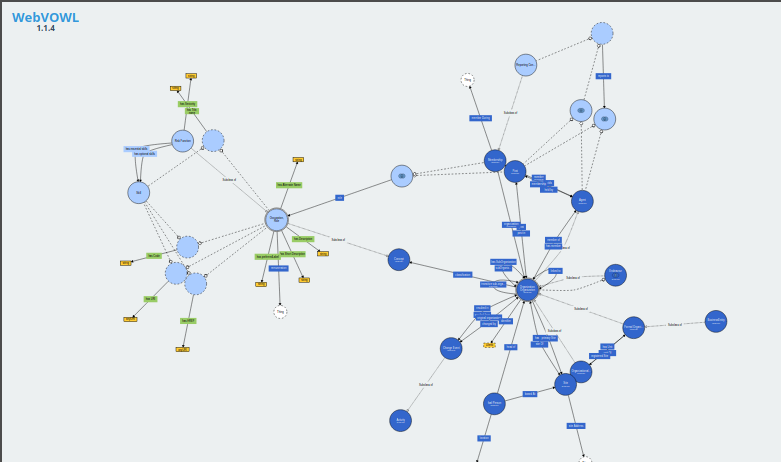

- We explore the owlready package and OWL ontologies

- We look into json-ld serialization of RDF/OWL data

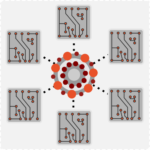

- We try data validation using pySHACL

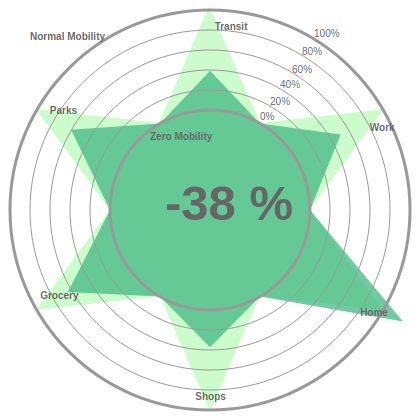

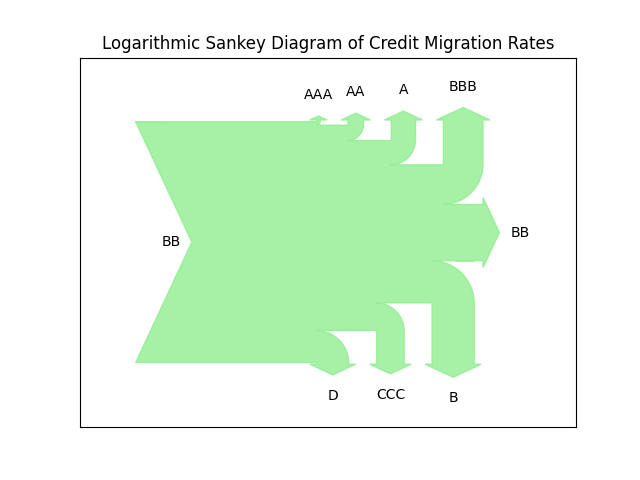

- We use throughout a realistic data set based on the Credit Ratings Ontology