IFRS 9 Expected Credit Loss and Risk Capital

The new IFRS 9 financial reporting standard

IFRS 9 (and the closely related CECL) is a brand new financial reporting standard developed and approved by the International Accounting Standards Board (IASB).

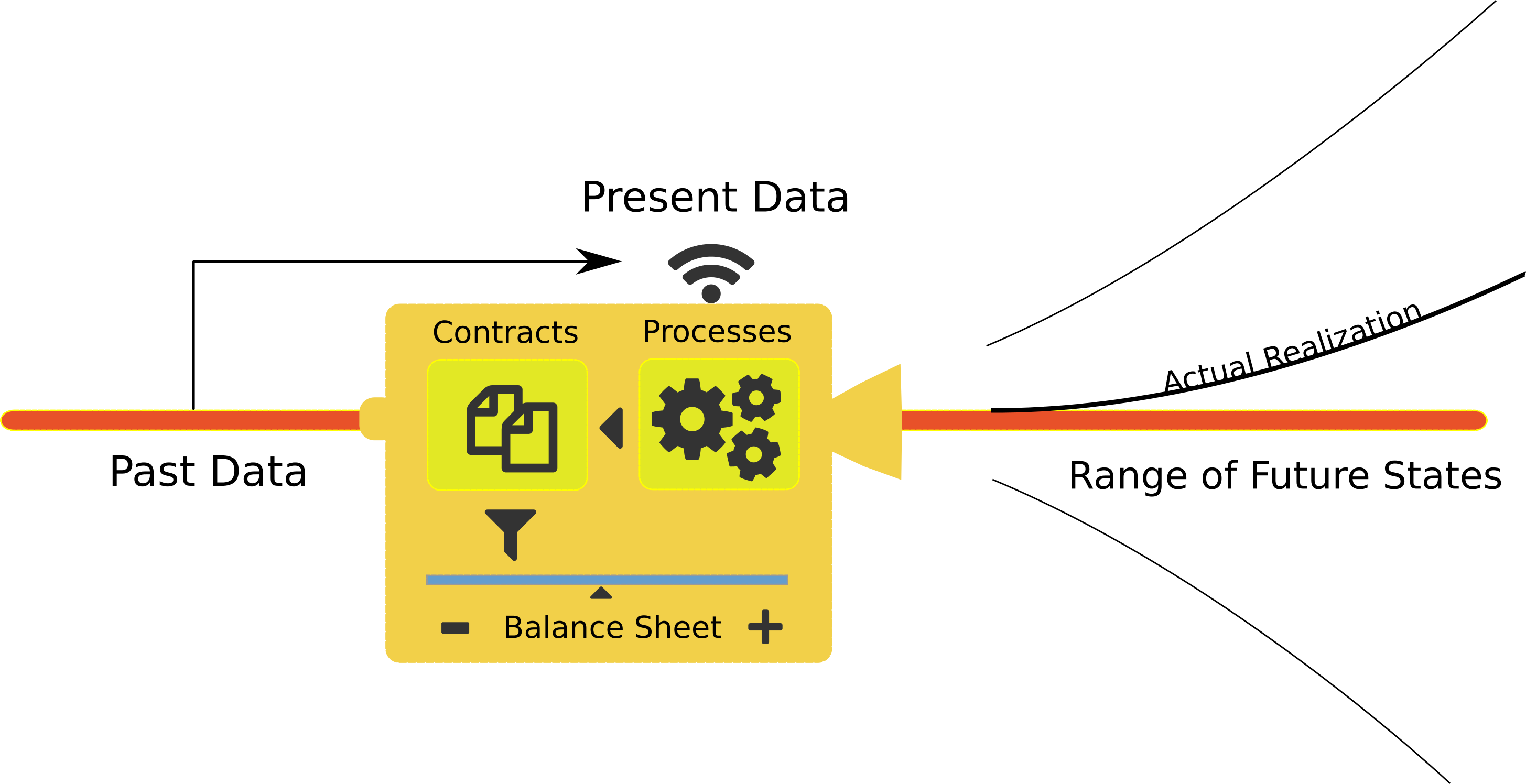

Strictly speaking IFRS 9 concerns only the accounting and reporting of financial instruments (e.g. bank loans and similar credit products). Yet the introduction of the IFRS 9 standard has significant repercussions beyond financial reporting, and touches e.g., bank risk management as well. This is prompted by the fact that the framework requires embedding forward looking risk assessments in the measurement of the value of credit assets currently on the balance sheet.