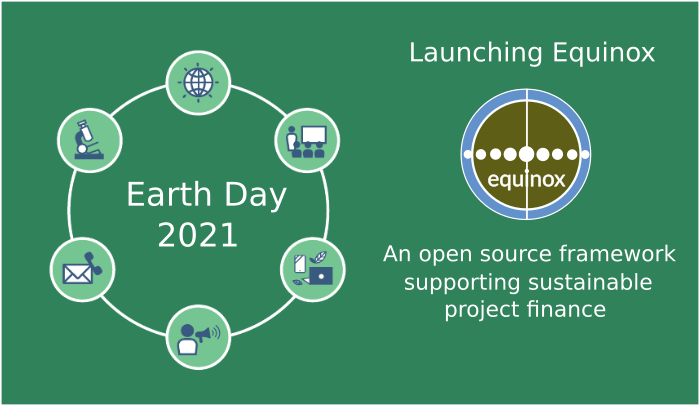

5000 Members of Sustainable Finance Subreddit

The Sustainable Finance forum is dedicated to news, events, ideas, research, funding, data and tools relevant to sustainable finance and has just crossed the five thousand member threshold!

Interest in Sustainable Finance is growing

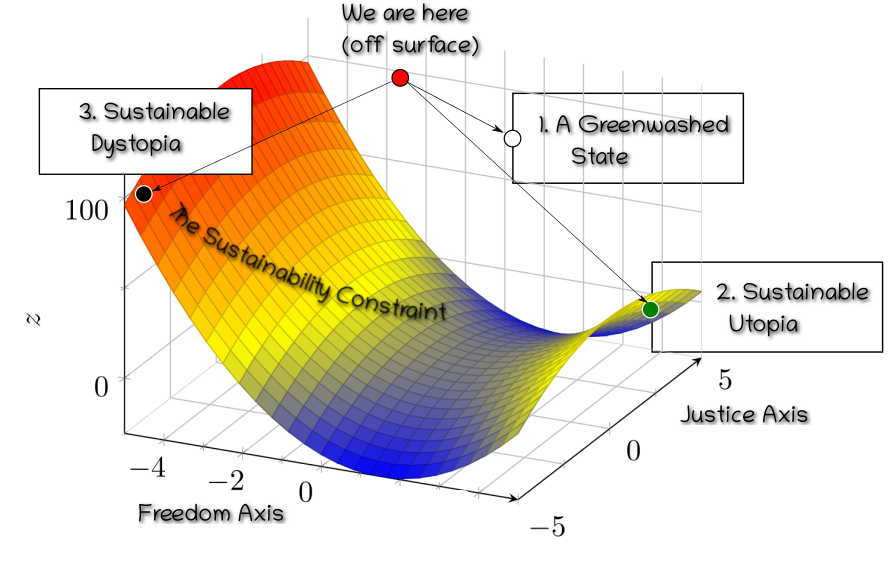

What is “Sustainable Finance”? A working definition is: A financial system that takes into account environmental, social and governance considerations to ensure long term sustainability of the human economy.

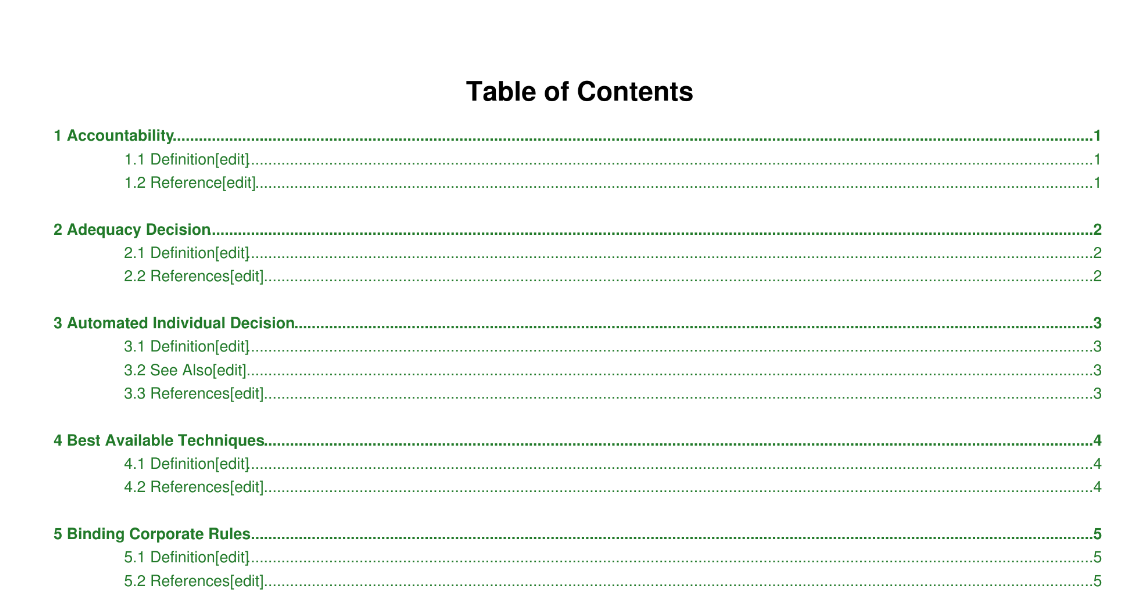

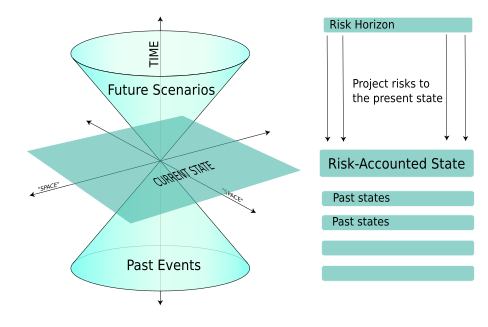

You can imagine that with a scope and ambition that sweeping, the devil hidden in the details will be of gargantuan size. The definitions of so-called ESG factors, the incorporation of sustainability into business strategies, the governance, policies and risk management applicable to ESG Risks, the ESG and climate-related disclosures and the development of “green” financial products are all topics that combine urgency, complexity and potentially dramatic impact.