Equinox Equator Principles Workflows

A group of workflows implemented in Equinox revolve around the Equator Principles . The Equator Principles is a (voluntary) risk management framework, developed and adopted by financial institutions for determining, assessing and managing environmental and social risk in projects (Project Finance ). It is primarily intended to provide a minimum standard for due diligence and monitoring to support responsible risk decision-making.

Portfolio Management Perspectives

There are three distinct perspectives in which one can use the Equinox platform to implement Sustainable Portfolio Management in the context of Projects and Project Finance. Each perspective brings its own characteristics as to what are the objectives of the Portfolio Manager and what are the portfolio data they have access to. The Equator Principles provide a worked out conceptual scaffolding as to what are relevant pieces of information and how they are exchanged between various stakeholders.

- the perspective of a Sponsor of Projects, for example an equity investor with a portfolio of projects. This perspective has the most granular access to project data as it is unencumbered by commercial secrecy constraints. In terms of the GHG Protocol , for each one of the projects the protocol for projects specifies how to perform and report detailed alternatives analysis. For a portfolio of operating projects investors may also want to account for and report impacts according to the Corporate Value Chain (Scope 3) Standard

- the perspective of the Lender, providing project funding via Loans and related products, thus managing a portfolio of loans. Lenders are significant enablers of project development and operation and get access to private information. For a portfolio of Project Finance loans, lenders may need to attribute and report Scope 3 emissions (as per above). They may also want to analyse the forward evolution and convergence of portfolios using e.g., the PACTA Methodology .

- the third and final perspective we consider here is one of a third party (hence an entity not directly involved in the Project Finance transaction) that monitors this segment (examples would be Regulators, Public Sector, NGO’s, Journalists etc.). Depending on the role and mandate of such parties they might have access to less information about the Project. From the perspective of such entities portfolio information must include also data about lenders or other intermediaries that participate in Project Finance markets.

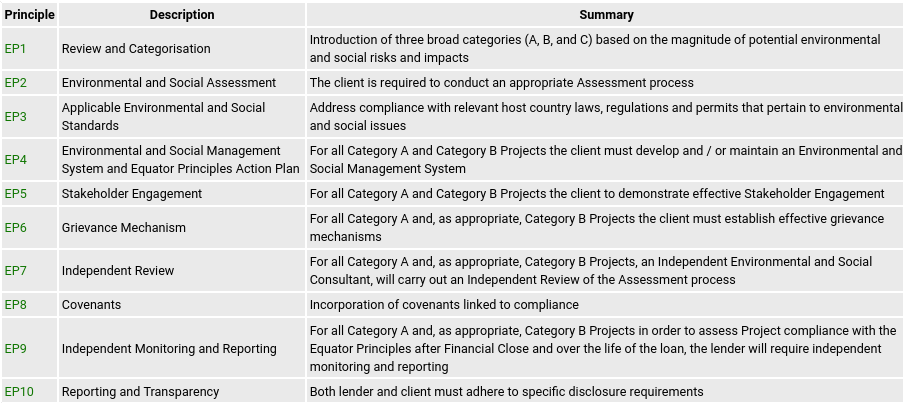

The role of the Equator Principles

The Equator Principles (EP) is a voluntary financial industry benchmark for determining, assessing and managing environmental and social risk (ESG Risks) in Project Finance. The initiative goes back to 2003, thus significantly preceding the current developments around Sustainable Finance . Adoption of the EP has grown from the original 10 adopters to 138 entities as of 2023 (domiciled in 38 different countries).

Review and Categorization

Equator Principle 1 defines three classes of projects according to an overall ESG Risk profile. In Equinox the EP Category class is an attribute of the Project Company. A Project Company is a Legal Entity that finances a Project. It is the main abstraction to represent businesses or other entities that the portfolio manager maintains economic relationships with (provides financing, is trading in good or services etc.). In the Project Finance context it is the legal entity (Special Purpose Vehicle or similar) that is being setup to finance a project.

Environmental and Social Assessment

The Project Company is but a legal construct. Equator Principle 2 stipulates the type of data that must be collected about the actual Project that is being finance and its environmental and social impact. The Equator Principles cover also the social dimension of the ESG criteria by explicitly documenting stakeholder relations in all phases of a project development and operation.

Within Equinox, the current implementation of the workflow focuses on capturing in the database the final outcomes of the EP compliance assessments and enabling users to easily query or monitor the status of the overall portfolio.

Further Reading and References

Similar to more general Portfolio Management practices and tools, sustainable portfolio management approaches may vary depending on:

the nature of the portfolio and its constituent instruments (e.g. credit portfolios, securities, derivatives etc.)

the business model of the Portfolio Manager (trading, buy-and-hold investor etc.)

the business values, objectives and constraints of the portfolio manager (e.g., financial return, impact investor, etc.)

Check out other Equinox use cases and Workflows

- The GHG Scope 2 Workflow focuses on Scope 2 (purchased electricity) accounting and reporting.

- The Green Public Procurement Workflow that supports analysis conforming to the data models of the European Union TED platform.

- The CIRIS Workflow for compiling a City-wide emissions report

- The PCAF Mortgages Workflow for compling the emissions profile of a portfolio of mortgages (loans secured against real estate with measurable GHG emissions).

- The GHG Project Workflow that focuses on individual Project impact analysis (thus this is an example that does not need involve a portfolio).

- The Emission Factor Database Workflow illustrates working with reference data (in this case the IPCC emissions factor database)

- The EBA Scorecard for Project Finance implements a standardized credit scorecard for Project Finance