How Open Data and Open Source can support Green Public Procurement - Part 4

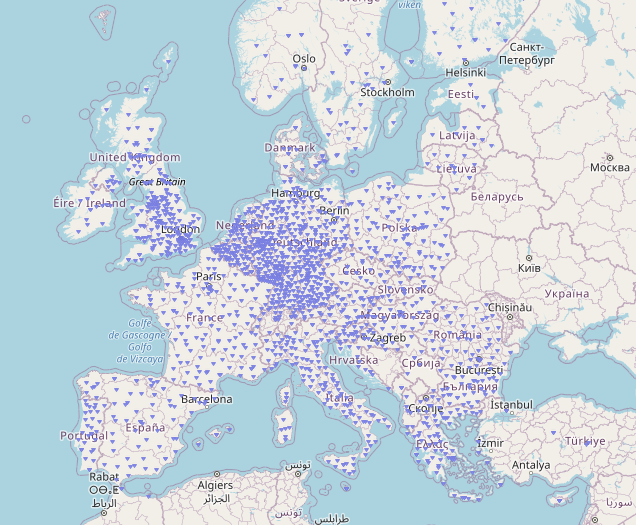

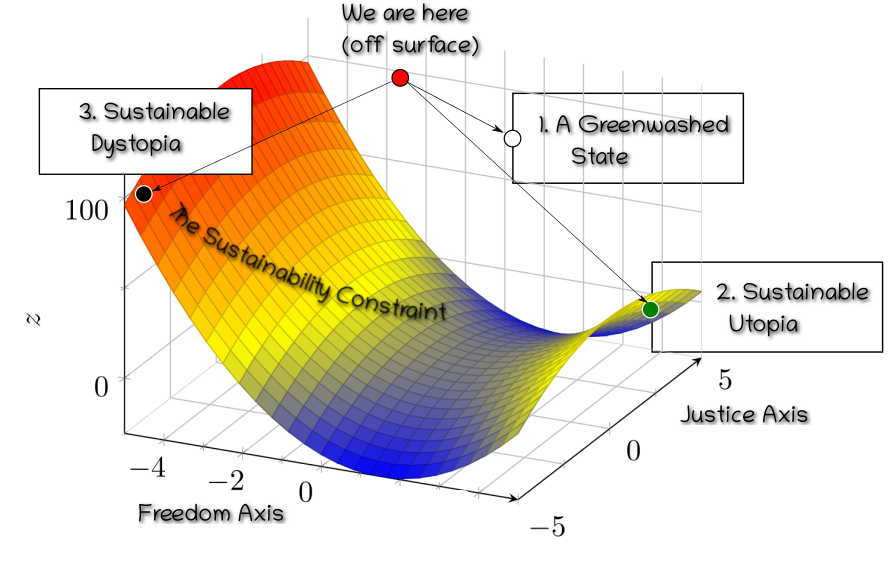

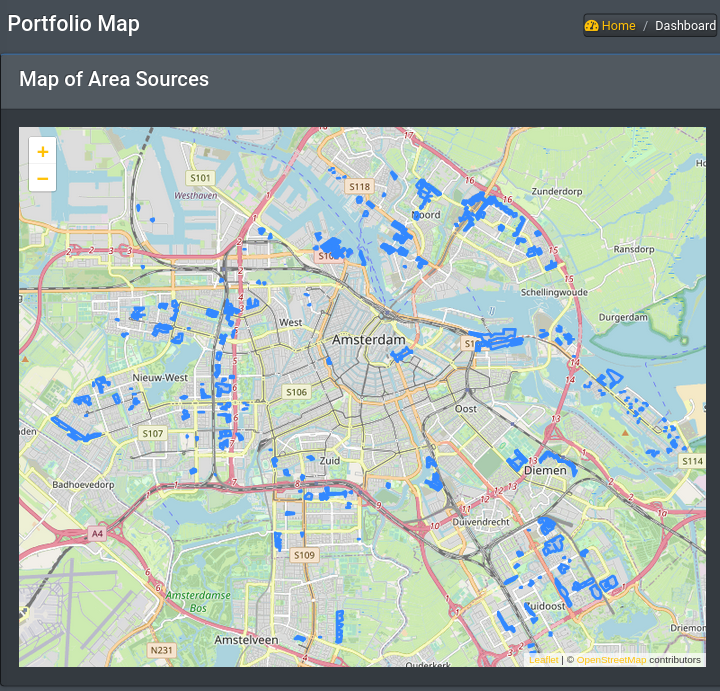

In the fourth part of this series we approach Green Public Procurement as a Sustainable Portfolio Management task and explore how open data can support this mission

Introduction

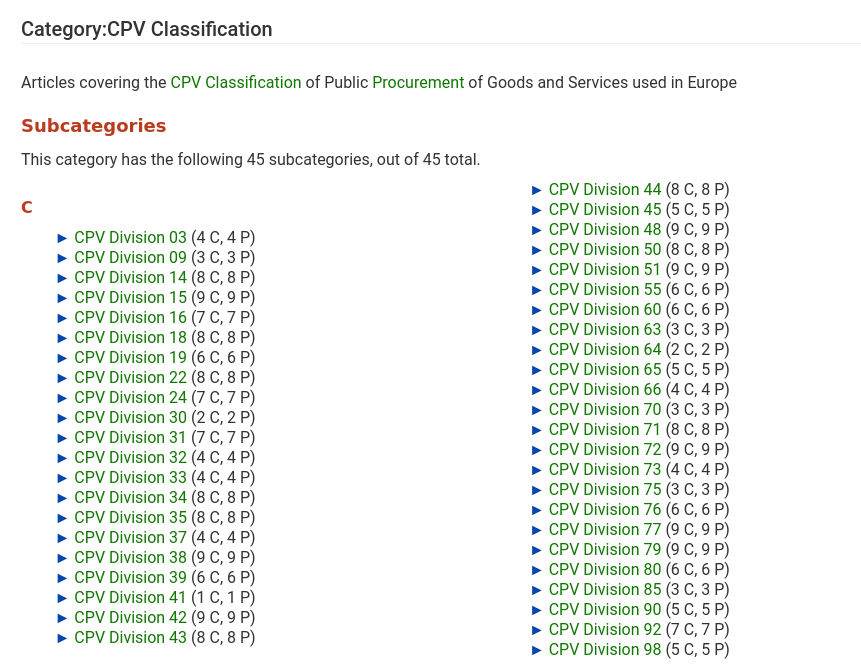

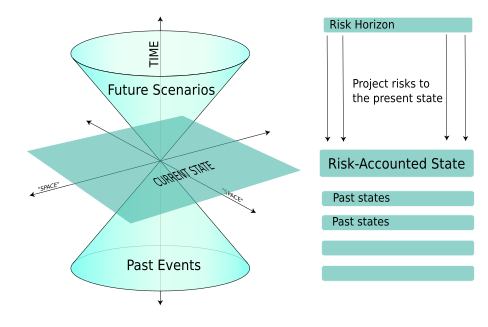

In this fourth and final installment we will discuss how the data framework we have developed thus far can be mapped into classic portfolio management concepts and categories, and thus, how one can articulate the concept of sustainable procurement management on a portfolio basis. The concepts and analytic methodologies of financial portfolio management1 can significantly enhance the toolkit available to practitioners and, in sense, connects the domain of Green Public Procurement to other ongoing initiatives in broader Sustainable Finance.