Taxonomy of Uncertainty

We review and synthesize into a taxonomy a number of related concepts and terms describing uncertainty, risk, randomness and model risk

Risk, Randomness, Uncertainty and other Ambiguous Terms

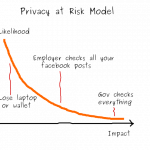

Uncertainty versus Risk is a popular discussion topic among risk managers, especially after major risk management disasters. The debate can get really hairy and drift into deep philosophical areas about the nature of knowledge etc. Yet the significance of having an as clear as possible language toolkit around these terms should not be underestimated. Practical risk management typically shuns too deep excursions into the meaning of things, yet that is not quite compatible with the use of sophisticated methods and tools (such as a Risk Model ) that assumes an understanding of the scope and limitations of “knowledge”.